Productivity Metrics

• Average setup times

• Capacity utilization

• Sales per employee

• Value-added

This year, 88 companies participated in the survey, mostly metal stampers that supply a variety of industries. Here’s more information on the companies that confidentially shared their data with PMA:

• 78 percent identify themselves as metal stampers, 9 percent work in metal spinning and 7 percent work in metal fabricating.

• 78 percent identify themselves as metal stampers, 9 percent work in metal spinning and 7 percent work in metal fabricating.

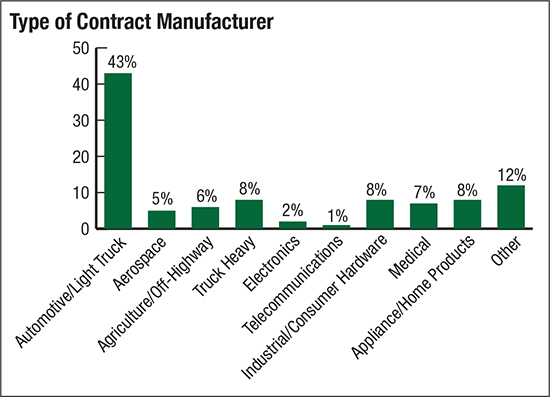

• About 43 percent of respondents indicate their primary industry is automotive. Industrial/consumer hardware, appliances/home products and agriculture/off-highway are the next highest industries represented, at approximately 8 percent each.

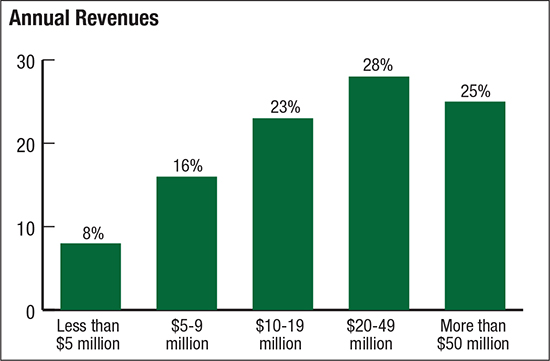

• 28 percent of the companies have sales between $20 and $49 million, and 25 have sales exceeding $50 million.

• 31 percent of survey participants employ between 50 and 100 people; 27 percent employ 100 to 249 people, and 19 have 250 to 500 employees; 88 percent have a nonunion workforce.

Are Volumes Up Compared to the Prior Year?

To find out, we tracked the results of repeat participants. A total of 60 companies participated in both the 2014 and 2013 surveys. These companies reported a combined total value of shipments (sales) of $2.26 billion in 2014, compared to $2.13 billion in 2013—a 5.32-percent increase.

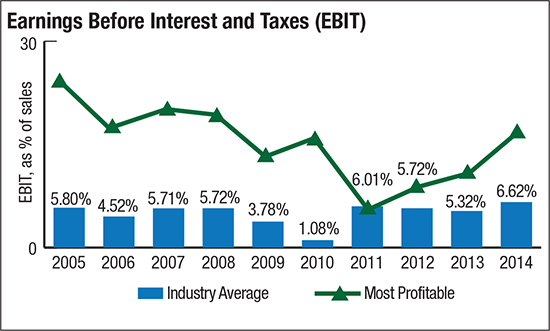

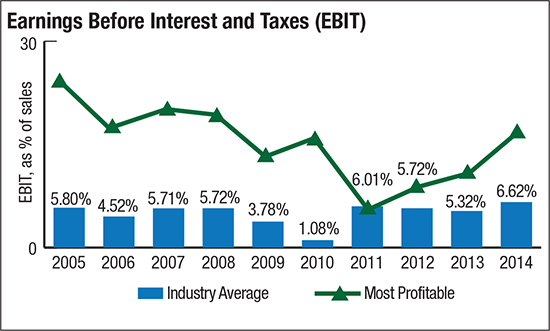

The survey also tracks industry profitability, measuring earnings before interest and taxes (EBIT)—viewed as an equivalent to operating income. Average EBIT has consistently ranged between 5 and 6 percent of sales for the last 10 years, except for the years impacted by the economic downturn in 2008-2009. In 2014, the EBIT calculation showed a result of 6.62 percent, the highest rate in the past 10 years. The most profitable companies report average EBIT between 13 and 25 percent of sales over the same 10-yr. period.

The survey also tracks industry profitability, measuring earnings before interest and taxes (EBIT)—viewed as an equivalent to operating income. Average EBIT has consistently ranged between 5 and 6 percent of sales for the last 10 years, except for the years impacted by the economic downturn in 2008-2009. In 2014, the EBIT calculation showed a result of 6.62 percent, the highest rate in the past 10 years. The most profitable companies report average EBIT between 13 and 25 percent of sales over the same 10-yr. period.

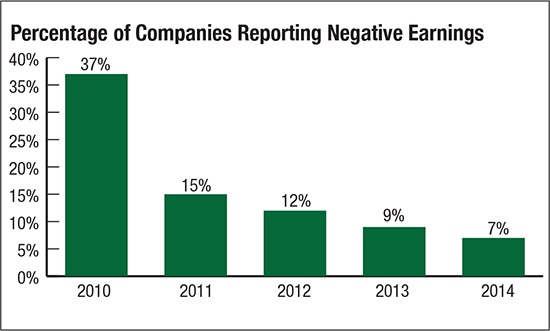

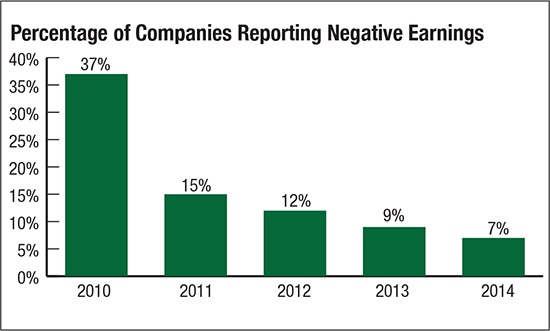

The survey also tracks the number of companies with negative earnings. This metric has decreased steadily over the last several years. In 2010, close to 40 percent of survey participants reported negative earnings. In 2014, that number dropped to 7 percent.

One common question: “What’s the profitability for automotive companies versus nonautomotive?” In 2014 the average profitability of automotive companies scored 5.31 percent, below the industry average of 6.62 percent. Nonautomotive companies experienced an average profitability of 9.07 percent, significantly higher than the industry average.

Forecast for 2015

Based on discussions at recent PMA district meetings, the outlook for 2015 is cautiously optimistic. This has been the sentiment for the past few years, as most executives expect sales and profitability to increase yet remain concerned about the increased activity and their ability to find enough qualified employees to support increased operating capacity.

Increased sales also may require additional capital expenditures. Based on the 2014 survey data, most companies have increased their capital expenditures each of the last three years in order to meet the demands of increased activity. MF

Technologies: Management, Quality Control

Robert Dobrowsky

Robert Dobrowsky • Training

• Training • Customer rejections

• Customer rejections

• 78 percent identify themselves as metal stampers, 9 percent work in metal spinning and 7 percent work in metal fabricating.

• 78 percent identify themselves as metal stampers, 9 percent work in metal spinning and 7 percent work in metal fabricating.  The survey also tracks industry profitability, measuring earnings before interest and taxes (EBIT)—viewed as an equivalent to operating income. Average EBIT has consistently ranged between 5 and 6 percent of sales for the last 10 years, except for the years impacted by the economic downturn in 2008-2009. In 2014, the EBIT calculation showed a result of 6.62 percent, the highest rate in the past 10 years. The most profitable companies report average EBIT between 13 and 25 percent of sales over the same 10-yr. period.

The survey also tracks industry profitability, measuring earnings before interest and taxes (EBIT)—viewed as an equivalent to operating income. Average EBIT has consistently ranged between 5 and 6 percent of sales for the last 10 years, except for the years impacted by the economic downturn in 2008-2009. In 2014, the EBIT calculation showed a result of 6.62 percent, the highest rate in the past 10 years. The most profitable companies report average EBIT between 13 and 25 percent of sales over the same 10-yr. period.

Podcast

Podcast

Webinar

Webinar