Irv Blackman

Irv BlackmanBeat the IRS Double-Tax Monster...Legally

May 1, 2017Comments

Are you lucky enough to be rich? That is, are you in the highest income tax and highest estate tax brackets? Is one of your significant assets a large amount—say, $1 million or more—in a qualified plan such as an IRA, 401(k), profit-sharing, etc.?

Those big-dollar numbers in your plan sure look good, but have you done the dreadful tax math? Let’s do it together. To make it easy, suppose that you take $1 out of your plan. The IRS takes 36 cents in income tax, leaving you with 64 cents. When you pass away, the IRS gets you again via the estate tax. This time for 40 percent of the 64 cents. Totaled, the double-tax monster leaves your family with 38 cents from that initial $1 withdrawal. Chances are that Congress will change the tax rates—raising or lowering the after-tax results. But one thing is certain: The double-tax monster will not go hungry.

Extrapolating from the above example, from $1 million in your plan, the tax collector gets $620,000, with $380,000 to your family. But wait, there’s more. Your state of residence, except for the few tax-free states, gets an additional piece of the tax action. Of course, over time your plan investments should grow. Unfortunately, that growth only adds to your tax pain.

You probably don’t need your plan funds to maintain your lifestyle. But, like it or not, the year after you reach age 70-and-a-half, you must take a “required minimum distribution” (RMD) at 3.65 percent of your plan balance the first year. The RMD rises a bit every year, reaching 5.13 percent in year 10, 8.33 percent in year 20, etc. Those RMDs someday will be clobbered by estate taxes. But the real villain is income in respect of a decedent (IRD). What is IRD? It is the amount in your plan on the day that you die. It’s double-taxed. Simply put, RMD (while you are alive) and IRD (when you die) are designed to literally and legally steal your plan dollars.

Can you beat these two tax bandits? Yes, but how to do it seems to be a secret that few professionals are in on. Here’s how.

Joe, a taxpayer, is married to Mary, and a Roth IRA comes to their rescue. The best place to start is with a few basic rules concerning a Roth IRA:

- A rollover can be made from a traditional IRA or any other qualified plan (401(k), profit-sharing, pension, etc.) to a Roth IRA.

- The full amount rolled over to the Roth IRA is taxed as ordinary income at the time of the rollover. And, this rollover can be made at any age.

So, Joe passes. Mary initiates the rollover from Joe’s IRA to a Roth IRA. She now owns the Roth IRA and can take income tax-free distributions as she pleases, with no RMDs required. When Mary dies, the Roth IRA is subject only to estate taxes. In the meantime, she makes her three children the beneficiaries of her Roth IRA. The kids have two distribution choices:

- The Roth IRA account must be completely distributed within five years of Mary’s death.

- The funds can be paid out annually (as RMD) over the life expectancy of the beneficiaries starting the year after Mary dies. Of course, all distributions are income tax-free.

Note: Making your grandkids beneficiaries allows use of the life-expectancy choice to extend the distributions over two generations (typically 50 to 70 years or more).

By employing what I call the Double-Tax Reverse, you can kill the double-tax monster. While alive and at any age, Joe makes Mary the beneficiary of his IRA (all of Joe’s qualified plans would be rolled into this one IRA), and with the help of advisors he estimates the amount of income tax that will be due when Mary converts to a Roth IRA. Let’s assume that the estimated tax will be $1 million. So Joe buys a $1 million insurance policy on his life, naming Mary as the beneficiary. At Joe’s death, Mary rolls over Joe’s IRA to an IRA spousal rollover, which is a tax-free transaction, and converts that to a Roth IRA. She is free to name her children, grandchildren or trusts for their benefit as the beneficiaries of the new Roth IRA accounts. Mary receives the $1 million insurance proceeds from Joe’s policy tax-free, which she uses to pay the income tax due on the Roth IRA conversion.

With the Double-Tax Reversal, you enjoy three tax victories:

- Kill the double-tax monster… in effect, no income tax when the Roth IRA conversion completes.

- Create a tax-free piggy bank for your spouse for life.

- Enable tax-free distributions to your heirs for one (or more) generations.

Got a question or want a free analysis of your situation? Call me at 847/674-5295 or e-mail irv@irvblackman.com. MF

Technologies: Management

Comments

Must be logged in to post a comment. Sign in or Create an Account

There are no comments posted. Management

ManagementCetec ERP Launches AI Chatbot

Monday, February 26, 2024

Management

ManagementStamper Revels in the Enhanced Process Visibility Delivered ...

Friday, January 19, 2024

Management

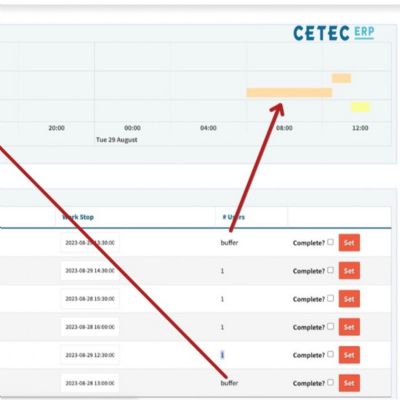

ManagementBuffer Scheduling Added to Cetec ERP to Improve Workflow

Wednesday, December 6, 2023