R&D Tax Credit—New Benefits for Metalformers

June 1, 2014Comments

Although the Research and Development (R&D) Tax Credit expired at the end of 2013 (for the ninth time since 1981), the Senate Finance Committee recently took the first step in passing the Expiring Provisions Improvement Reform and Efficiency (Expire) Act. This legislation would reenact the credit and extend it for 2014 and 2015—great news for metalformers, made even better considering that the proposed legislation includes more benefits than ever before.

|

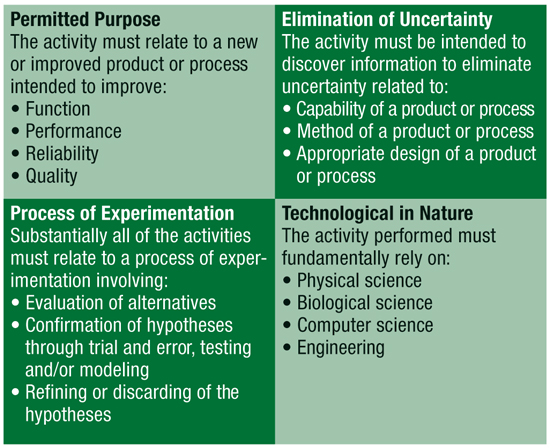

| Fig. 1 |

The Definition of R&D

Historically, qualified expenses eligible for R&D credits have included wages, supplies and contract research—for companies that incur these expenses in an activity that involves product development, process improvement, technical uncertainty or experimentation (Fig. 1). The credit is a true credit—not a deduction—that metalformers can use to offset against their regular tax.

Claiming the R&D Tax Credit Against the AMT

Perhaps the most exciting potential development, the proposed legislation allows small and medium-sized businesses to claim the R&D tax credit against the Alternative Minimum Tax (AMT). This is outstanding news for S Corps and partnerships, which pass all of their income through to their individual owners’ tax returns. Currently, individuals only can reduce their tax down to AMT; if the Expire Act passes, owners may be able to reduce their tax even lower, if they have enough in R&D credits.

Startups May Now Be Eligible

Legislation also would allow startups, not yet paying income tax, to benefit from the R&D credit for the first time ever; companies can take a credit of as much as $250,000 against the payroll taxes it pays on employee wages. However, only companies that have been around for less than 5 yr. and have less than $5 million in annual gross receipts would be eligible.

Claim the Credit for Sold Prototypes

Research expenses include costs to develop a product, including a pilot model. Proposed regulations issued in September 2013 define pilot models as fully functional prototypes. In addition, the proposed regulations clarify that the use or sale of the product is irrelevant in determining whether a cost qualifies.

In the past, many taxpayers only included expenses as qualified for the R&D credit if prototypes were used, consumed and disposed of. The new proposed regulations would allow metalformers to claim the credit for prototypes that are sold. No longer does the end use matter—prototypes may qualify whether they sit in inventory, are destroyed or are sold to customers. This is great news for metalformers who might spend upwards of $1 million on a single prototype or tool.

Process Improvements Also May Qualify

Even if a metalformer never makes new parts or designs new products, as long as it makes improvements to the manufacturing process that increase efficiency, quality, reliability, etc., it may qualify for an R&D tax credit. Companies that employ industrial, process or manufacturing engineers should look into this in particular.

What’s Next?

The bill now heads to the Senate floor. Given the strong bipartisan support, it likely will be brought forth for consideration sooner rather than later. The consensus is that legislation won’t pass until after the November elections. Still, metalformers would be wise to look at these R&D opportunities and determine how they might apply to their organizations. MF

The author thanks Amy Forester, a tax associate with Plante Moran specializing in helping manufacturers maximize the value of their available tax incentives.Technologies: Management

Comments

Must be logged in to post a comment. Sign in or Create an Account

There are no comments posted. Management

ManagementTariffs are Not a Strategy: A Call for Action by U.S. Manufa...

Laurie Harbour Tuesday, May 27, 2025

Management

ManagementProtecting Your Manufacturing Business Amidst Tariff Changes...

Mike Devereux Friday, May 2, 2025