Tariffs, Taxes and EVs: The Road Ahead for the Global Auto Industry

December 17, 2024Comments

The latest report from S&P Global Mobility notes that “the president-elect's proposed policies, including tax cuts, deregulation, tariffs and changes to EV incentives, will have ripple effects on global automotive markets, especially in North America and Europe. How these policies unfold will shape the future of battery electric vehicle (BEV) sales and global trade dynamics.”

The latest report from S&P Global Mobility notes that “the president-elect's proposed policies, including tax cuts, deregulation, tariffs and changes to EV incentives, will have ripple effects on global automotive markets, especially in North America and Europe. How these policies unfold will shape the future of battery electric vehicle (BEV) sales and global trade dynamics.”

Up for discussion:

- Tax cuts and vehicle affordability making the reductions from the Tax Cuts and Jobs Act of 2018 permanent, eliminating taxes on tipped income, overtime and social security benefits and removing the cap on state/local tax deductions could lead to higher demand—combined with potential inflationary pressure, that could then lead to higher borrowing costs, which would dampen vehicle affordability.

- Trade barriers/tariffs

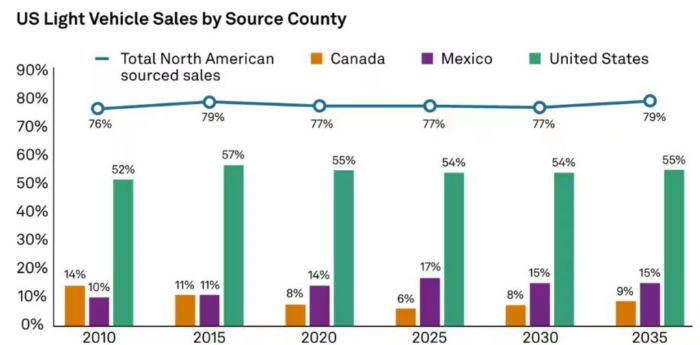

A proposed 10% tariff on imported vehicles from regions like Japan, Korea and Europe would directly impact 16% of U.S. vehicle sales. However, the more concerning aspect would be the potential for a 25% tariff on imports from Canada and Mexico.

- The effect of deregulation on BEV sales

The rollback of environmental regulations, including fuel economy standards and incentives for BEVs, could undermine the US market's previous trajectory toward electric vehicles.

Technologies: Management