The Economy and Manufacturing in 2025

January 2, 2025Comments

Looking at the U.S. economy, we’ve finally got some good things to talk about. Inflation has slowed, decreasing the cost of items; interest-rate hikes also have slowed, and cuts have begun; and unemployment is low.

Yet, long-term GDP growth sits between 2 and 3%, pretty flat. This means we aren’t on the brink of a massive economic expansion, but there is some growth to be had. As manufacturers, you may see this as contradictory to what you are experiencing— for many, business is slow, volumes are being cut, tools are on hold or not being launched.

Macroeconomic View

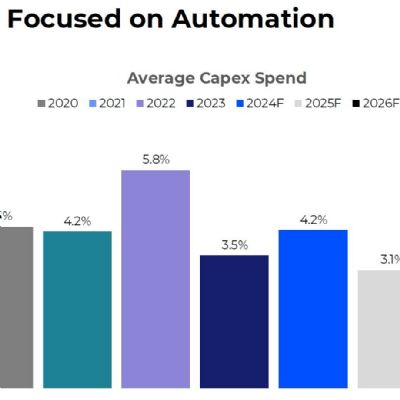

So, what’s going on? In the United States, we’ve gone from a time in the 1950s and 1960s when manufacturing represented almost 30% of global GDP—today it’s 9%. According to our Harbour IQ powered by Wipfli third-quarter benchmarking study, the average tool shop sits at 71% capacity utilization, lower than in 2021-2022. However, it’s important to remember that several shops no longer are in business or included in the data set, especially in the automotive-tooling industry. So, realistically the capacity level for all tool shops, not just the ones in our data, probably is closer to 50%. This means that the average full-time tool shop isn’t massively utilized.

Directly correlated to capacity utilization is durable-goods demand—if we aren’t buying goods, we’re not going to need tools to make them. During COVID-19, we had higher capacity utilization on average. Then we started having supply-chain challenges, which is when capacity utilization started to fall.

Manufacturers face a challenging economic marketplace, with negative durable-goods demand growth year-over-year. This is due to events happening across the globe—the war in the Ukraine, climate challenges, government-leader resignations, supply-chain issues and labor unrest—impacting business.

U.S. Presidential elections typically do not change the Federal Reserve’s plan for interest-rate hikes or cuts, and President-elect Trump’s reentry to office will be no different. Despite some tensions between Trump and Federal Reserve Chairman Powell, the Fed still plans for rate cuts in 2025.

As for tariffs, there are a lot, and we’ve already heard to expect more, anywhere from 25 to 100%, specifically tariffs on goods from China. Economists typically don’t like tariffs because they raise costs and bump up inflation, but from a non-economic perspective, they help us manufacture more goods in this country.