Per DelmiaWorks’ Bieszczat: “We also see customers increasing their desire to replace their open-loop supply chain with a more closed-loop supply chain, buying more from fewer vendors. In a similar vein, customers are demanding to know the genealogy of parts, where they came from and how they were made. Even customers not working with consolidated supply chains seek to closely monitor their supply chains by requiring suppliers and contract manufacturers to document the parts and products they are delivering.

“More metal fabricators will move to near lights-out production shifts, supported by the use of robots,” he adds. “Running a full lights-out operation can require a significant upfront investment and is best-suited for large production runs of the same products or components. But even small batch operations can gain the benefits of near-lights-out operations where flexible robots handle increasing percentages of the pick-and-place operations.”

What follows are some key data and talking points compiled by our editorial team for several end-use markets of interest to metal formers and fabricators.—BK

Automotive Industry Outlook

A year ago, the outlook for the automotive industry in 2023 was dim and forecasts were dire: There were warnings of potential “demand destruction,” a “sputtering economy” and a “job-wrecking recession.”

Rumors of the dearth of auto-segment activity were greatly exaggerated, it appears.

Rumors of the dearth of auto-segment activity were greatly exaggerated, it appears.

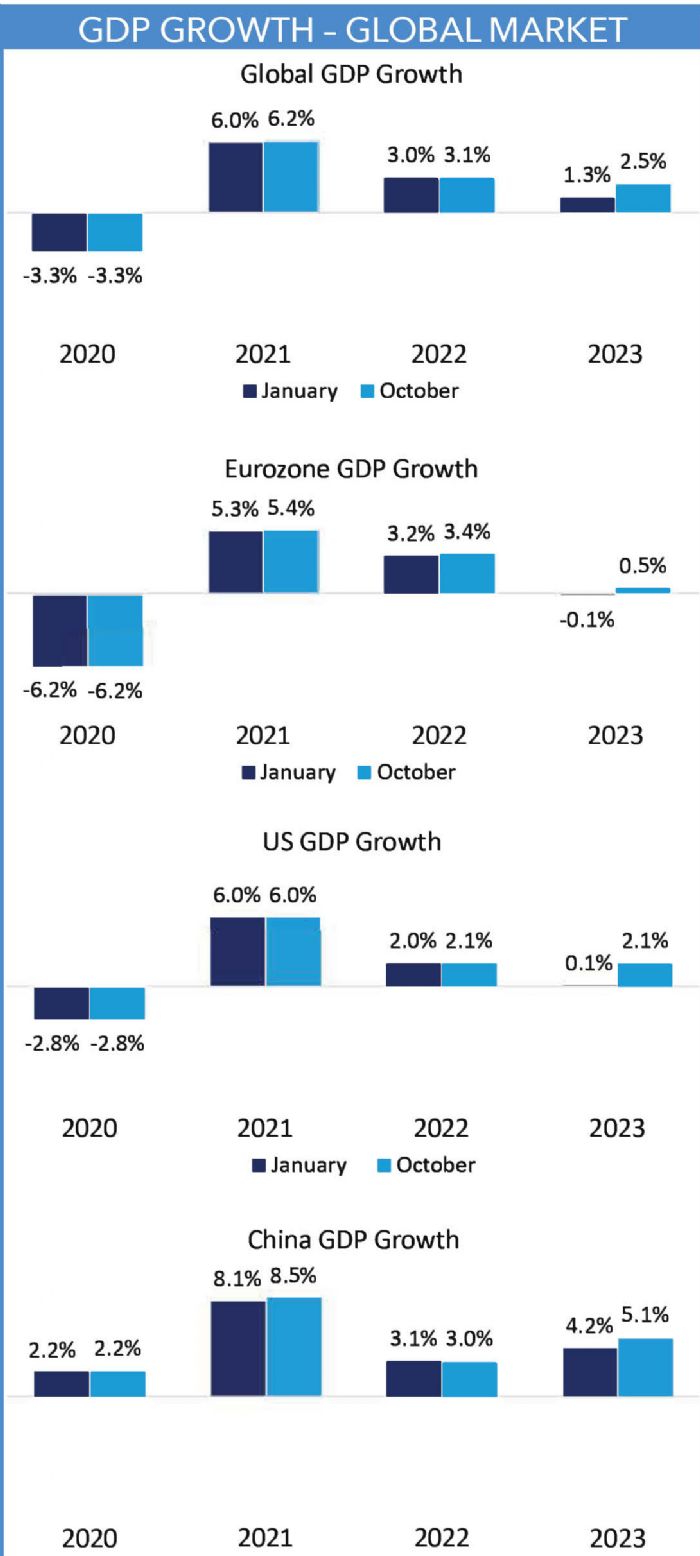

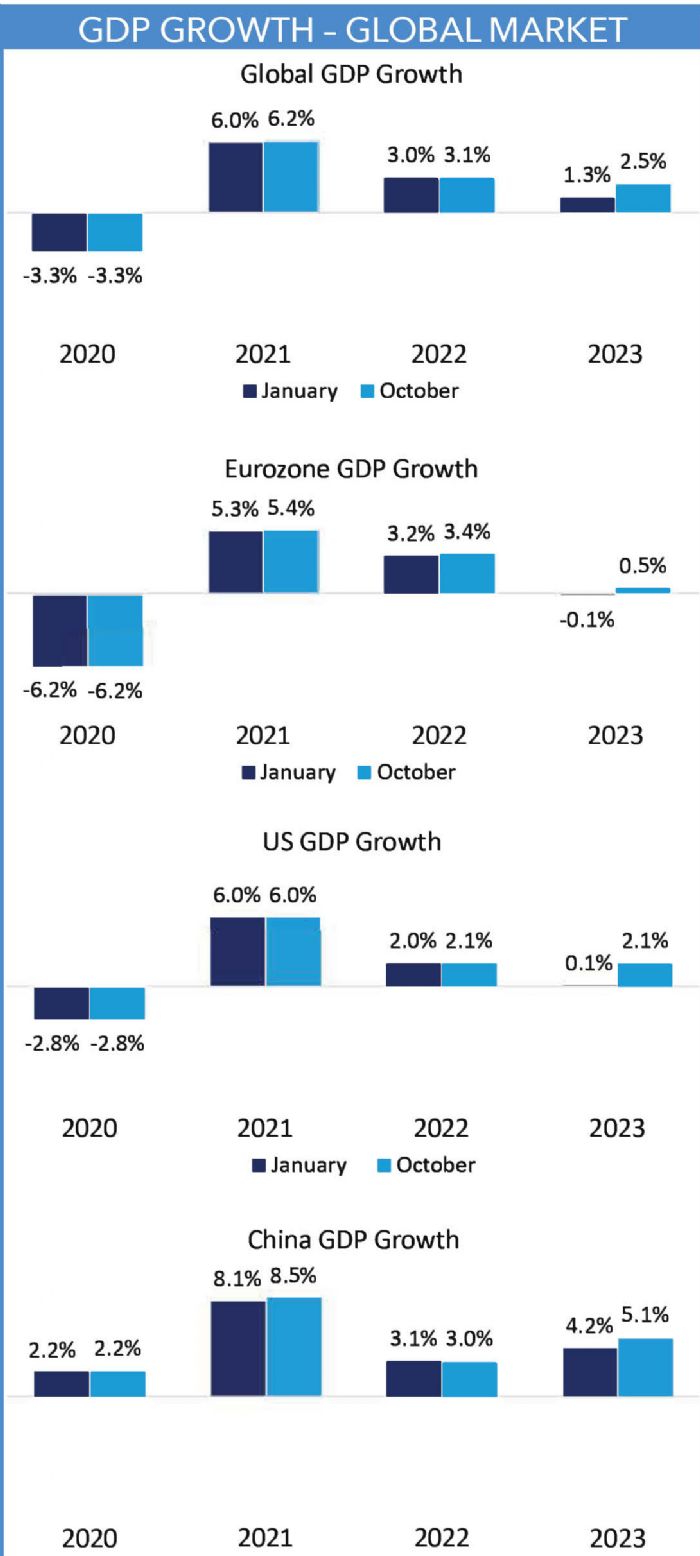

The 2023 global market outperformed expectations despite some adverse conditions, says Jeff Schuster, executive vice president of GlobalData, in his PMA Automotive Parts Supplier Conference presentation, “Global Automotive Outlook: Navigating Chaos.” Even with an elevated rate of inflation worldwide, and production halts inherent in the UAW strike stateside, vehicle sales rebounded in 2023—globally and domestically, propped up by better-than-expected economic indicators.

The U.S. gross domestic product (GDP) in 2023 measured a robust 4.9% in the third quarter. Unemployment remained low throughout 2023—3.6% on average. By October, inflation measured 3.2%, and wages increased an estimated 5.7% from January to October.

The economic recovery resuscitated the global and domestic automotive segments.

Inventory. U.S. light vehicle inventory at the end of 2023 reached its highest level since April 2021, Schuster said, with light-vehicle supply at about 80 days—21% longer than the “normal” inventory duration.

China had less disruption impact, but inventory levels were impacted by COVID restrictions. A surge at the end of 2022 drove down stock levels. And Europe’s inventory is expected to end down by 30% in 2023 from 2019 levels.

The pandemic-induced supply-chain disruption has not been resolved completely, but it is in the rear-view mirror, Schuster says. Minimal structural gap between supply and demand is expected to continue.

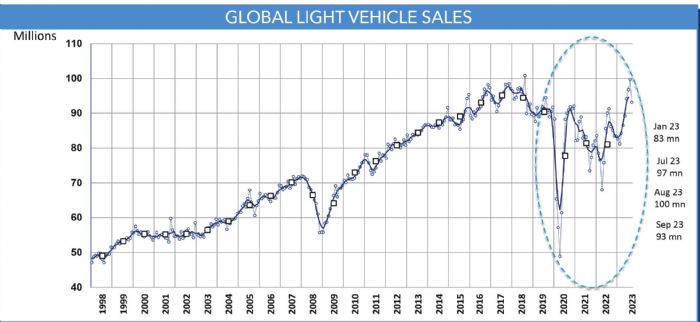

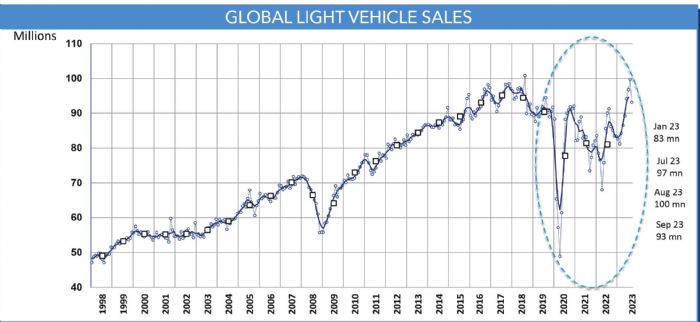

Global Sales. Global light-vehicle output grew by 11% from January to August 2023, GlobalData reports. Volumes are estimated at 88.8 million in 2023, an increase from 78 million in 2020.

S&P Global Mobility forecasts 88.3 million new-vehicle sales worldwide in 2024 as the recovery rolls on. “With the brakes off of the supply chain, the risk to further growth is that demand momentum fades as consumer uncertainty overtakes pent-up demand,” the analyst organization reports.

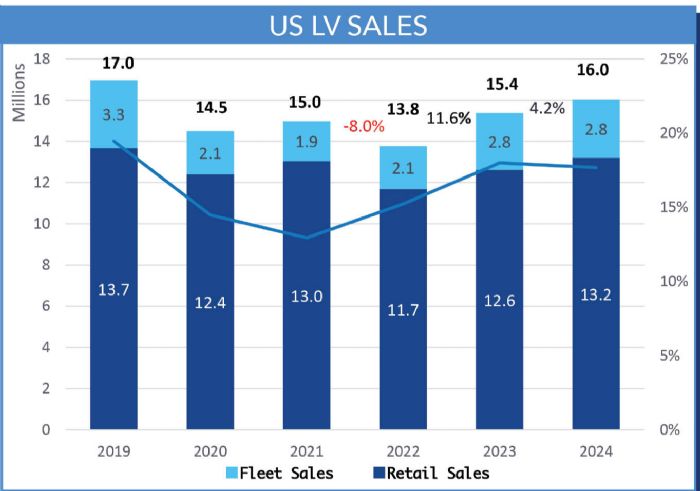

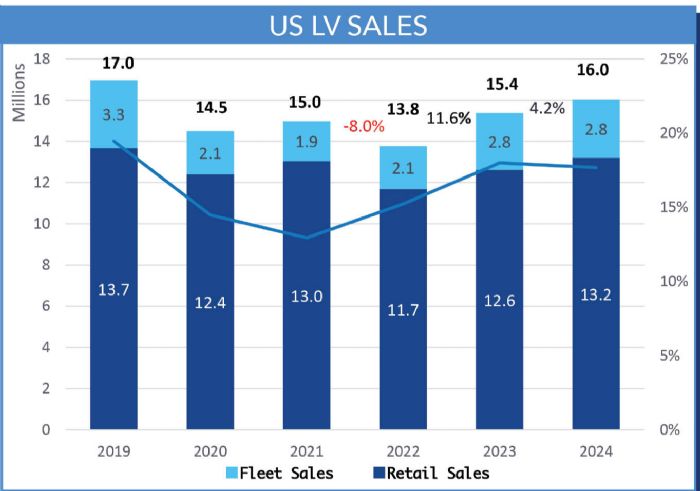

U.S Sales. In the United States, automakers sold roughly 15.4 million vehicles in 2023, an increase of 11.6% from 2022. GlobalData forecasts that U.S. light-vehicles sales will continue climbing into 2024, albeit by a slower rate of 4.2% to 16 million.

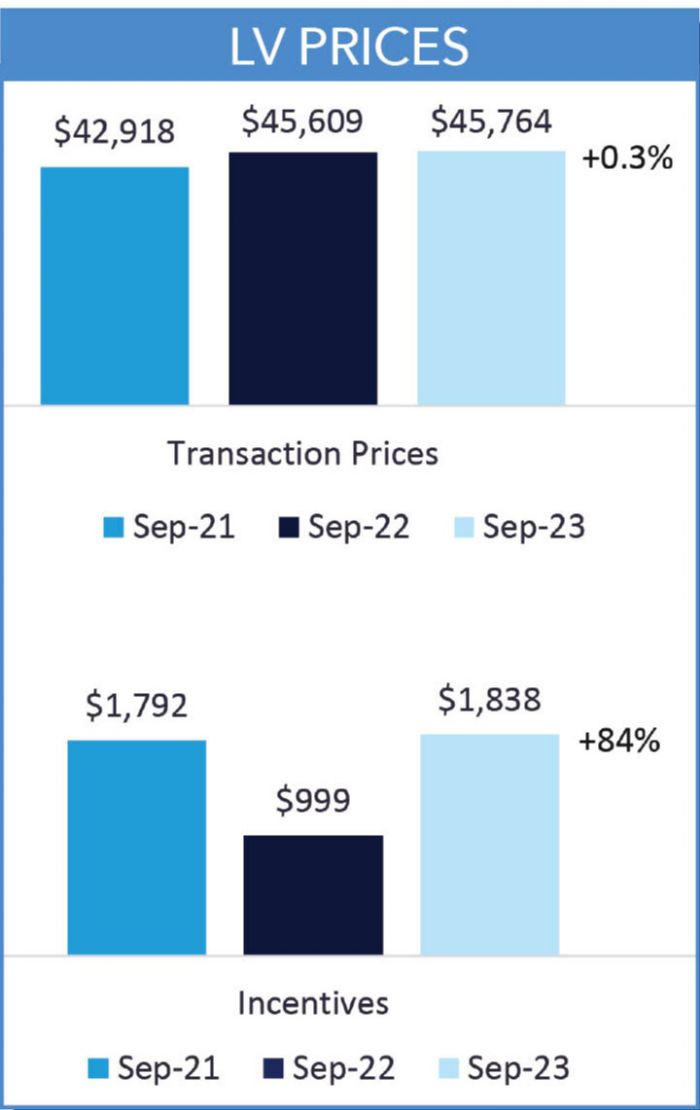

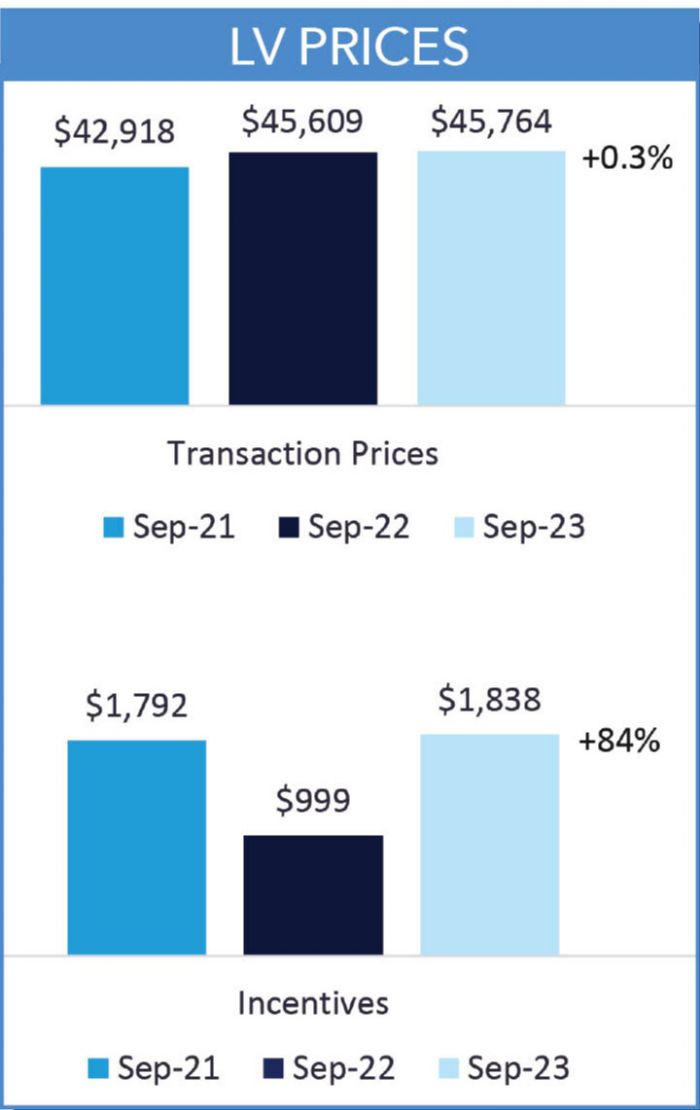

Prices and Profits. After three years of escalation, U.S. vehicle prices are beginning to level off as a result of inclining inventories, Schuster says. The average transaction price for a new vehicle in October 2023 was $47,936, a 1.4% decline year over year; according to Cox Automotive, parent company of Kelley Blue Book.

Automaker profits also soared. Stellantis reported a profit of $11.6 billion in the first half of 2023; Ford at $3.7 billion; and GM at $5 billion—a point made by the UAW as a lever in contract negotiations.

Reports from Cox Automotive reveal that all electric-vehicle (EV) registrations in the United States exceeded 800,000 units by September 2023—a respectable 7.4% of all new-vehicle registrations. Cox predicts that, based on that trajectory, U.S. 2023 sales will have blown past 1 million units for the first time.

In the European market, EV sales nearly doubled U.S. sales, at 14.3%; China’s EV sales tripled that of the United States, at 22.6%. Overall, battery electric vehicles (BEVs) lead all other EV forms in sales.

In the European market, EV sales nearly doubled U.S. sales, at 14.3%; China’s EV sales tripled that of the United States, at 22.6%. Overall, battery electric vehicles (BEVs) lead all other EV forms in sales.

The average price paid for a new EV in October was $51,762. Even with the gains in October, average EV prices are down more than $13,000 year over year, according to KBB.

EV growth shows signs of slowing, however, Cox forecasts.

Tooling-Business Activity Boosted by Dual Propulsion. The dual propulsion situation puts tool and diemakers in a sweet spot, according to Laurie Harbour, president & CEO, Harbour Results, noting that many new internal-combustion-engine vehicles and new BEV products will enter the market. “A significant wallet is available for tool sourcing,” she says. “A lot of new products are coming, and over 4 yr. this accounts for $25 billion in tool spend. This is similar to what we saw in 2017-18—the largest spends in the history of the automotive tooling business. The future is bright for automotive.”—KB

Electrical Equipment/Electronics Industry Outlook

Siemens, Eaton, Johnson Electric and other manufacturers of electrical equipment—and their suppliers—enjoyed an overall healthy marketplace in 2023, as revenue in the segment climbed by more than 10%, according to data provided by several market-research firms. Driving forces include ramped-up sales of transformers, electric motors, switchgear and other related products.

Siemens, Eaton, Johnson Electric and other manufacturers of electrical equipment—and their suppliers—enjoyed an overall healthy marketplace in 2023, as revenue in the segment climbed by more than 10%, according to data provided by several market-research firms. Driving forces include ramped-up sales of transformers, electric motors, switchgear and other related products.

And, a report from IBIS World notes that “there is currently a transformer shortage and supply-demand imbalance in the country for the equipment.”

Of note: Siemens’ investment in two new manufacturing plants in Texas to manufacture switchboards and circuit breakers. Siemens says the new plants will support “accelerated growth” of U.S. data centers, being driven by “the exponential adoption of generative artificial intelligence.”

For its part, Eaton, late in 2023, opened a new 35,000-sq.-ft. global innovation center near Montreal, Canada, to accelerate the research and development of distributed energy resource technologies, vital in enabling sustainable electricity for buildings, homes, industry and the electric grid. And, earlier in 2023 the firm announced a $300 million investment in its North American manufacturing operations, to be realized throughout 2024 and 2025 to support growing demand for its electrical equipment. Included is a 200,000-sq.-ft. addition to its manufacturing facility in Nacogdoches, TX.

The long-term U.S. outlook for the segment, per Statista: a 2.5% CAGR through 2028. And offering a broader perspective, The Business Research Co. forecasts continued growth of the “general electrical equipment and components market,” defined as any electronic devices that generate, distribute and use electrical power. Globally, that market, it says, grew at a 7.2% CAGR in 2023, and should grow at a CAGR of 6.8% through 2028. Among driving forces: the shift toward eco-friendly and energy-efficient electrical equipment, from such notable suppliers as Samsung Electronics, ABB, Sumitomo and Toshiba.

Likewise, an end-of-year report from EPS News, authored by Flip Electronics’ president Bill Bradford, notes:

Likewise, an end-of-year report from EPS News, authored by Flip Electronics’ president Bill Bradford, notes:

“2024 has the hope of being a good recovery year for the semiconductor industry. We are starting to see lead times stabilizing and we’ll continue, as an industry, to work through the inventory overhang that has slowed sales down… Semiconductor sales are likely to strengthen by mid-2024—especially as sales are driven by emerging technologies like artificial intelligence (AI). Implementing these big ideas is going to take a lot of computing power. To build the networking infrastructure and raw computing power needed, OEMs are going to need a lot of chips.”

Finally, as noted in a recent report from the Deloitte Research Center for Energy & Industrials:

“In 2023, the U.S. power and utilities industry raised the decarbonization bar, deployed record-breaking volumes of solar power and energy storage, and boosted grid reliability and flexibility—with a healthy assist from landmark clean-energy and climate legislation. All of this likely will continue in 2024… Multiple-billion dollars were awarded under the Infrastructure Investment and Jobs Act in 2023 for grid reliability and resiliency, battery supply-chain development, electric-vehicle programs and energy efficiency, and more is on the way in the coming year.”

And, on the consumer-electronics front, stamping of metal clips, brackets, frames and similar parts continues to expand for products such as computers, smart kitchen appliances featuring AI and enhanced connectivity, smart locks and doorbells, and smart phones. Fortune Business Insights forecasts the global consumer electronics market to enjoy a CAGR of 7% through 2030.—BK

HVAC Market Outlook

Even with relatively high mortgage rates, overall low U.S. housing inventory and high home prices signal a housing-construction boom in 2024 and beyond, according to most experts. On the nonresidential side, rising energy costs are spurring commercial and institutional building owners and managers to invest in greener and more-energy-efficient systems. All of these factors translate to a surge in the HVAC market.

The North American HVAC equipment market is expected to grow at a CAGR of 6.29% from 2023 to 2028, according to Technavio, with a 5.71% year-over-year growth rate forecast for 2024. Worldwide, market size is projected to grow to $228.74 billion in 2030 (from $150.04 billion in 2022) at a CAGR of 5.5% during forecast period, say analysts from Fortune Business Insights.

With numerous industries expanding production volumes to fulfill growing demand for manufactured goods, the need has increased for energy-efficient equipment in various industrial operations. Consider that energy-intensive industries such as oil and gas, food and beverage, and power, spend nearly 40% of production costs on electricity. Such percentages drive regulatory authorities to encourage the adoption of energy-efficient equipment such as HVAC, according to Technavio.

With numerous industries expanding production volumes to fulfill growing demand for manufactured goods, the need has increased for energy-efficient equipment in various industrial operations. Consider that energy-intensive industries such as oil and gas, food and beverage, and power, spend nearly 40% of production costs on electricity. Such percentages drive regulatory authorities to encourage the adoption of energy-efficient equipment such as HVAC, according to Technavio.

A coming trend: the increase in the number of net-zero buildings—structures that, over the course of a year, generate energy onsite using clean renewable resources in a quantity equal to or greater than the total amount of energy consumed onsite. This rise in net zero-building popularity should boost the development of the nonresidential HVAC sector in coming years, according to Expert Market Research.

On the residential side, along with a rise in new-home construction, green is in, with energy-efficient solutions in high demand, offers ACHR News, noting that this demand only will increase in 2024.

The overall positive HVAC market forecast can be seen in financial forecasts for big players such as Lennox International, where predictions call for gains in 2024 sales and growth. And, big market providers are quite in tune with the green aspects of the market.

“Effectively, all things come back to sustainability for us,” Dave Gitlin, Carrier Global’s chairman and CEO, recently told Yahoo Finance, alluding to the company’s recent acquisitions and divestures that put a focus on intelligent climate and energy solutions as well as non-gas energy usage.—LK

Medical Device Market Overview

The market for medical instruments spent 2023 continuing its gradual emergence from a 2.5-yr.-long COVID-related focus on PPE. Now the focus has shifted back to more typical operations—think testing apparatus as well as devices and equipment used in operating rooms, as the number of elective procedures rises. And, as noted by a late-2023 report from Zacks, “artificial intelligence and robotics for medical Internet of Things, which rose to the limelight during the pandemic phase, continue to be popular. The medical-instruments space has been benefiting from the ongoing merger and acquisition trend,” the report adds. “Smaller and midsized industry players attempt to compete with the big shots through consolidation. The big players attempt to enter new markets through a niche product.”

Various market-research firms note that the global medical-equipment market should rise at a considerable pace through 2030. Among the new technological innovations cited as driving the demand for medical equipment: the introduction of new laser therapy to treat diseases, and the continued growth in the use of smart devices, with orthopedics cited as one example.

FDA Ramping Up its Device Approvals. Another industry trend, noted by Fortune Business Insights: The global wearable medical devices market (think Fitbits, biosensors and hearing aids) is expected to grow at a CAGR of 28.6% through 2030. Driving the increased use of wearable devices: the increasing prevalence of chronic diseases and lifestyle-related disorders, including the rise in the number of people living with diabetes.

In addition, a report from the healthcare investment-banking experts at Cain Brothers, a division of KeyBanc Capital Markets, notes this trend: Since 2020, the number of new medical devices approved by the FDA has risen by more than 20% annually. And industry pundits note a surge in the development of AI- or machine-learning-enabled medical devices, aided by advances in sensor technology.

That rapid pace of innovation is only partly fueled by growing demand. “It’s also been enabled by advances in technology—ranging from 3D printing, injection molding and sterilization to the incorporation of digital technology and remote monitoring,” the report reads, “the rise of minimally invasive surgical procedures, and robot-assisted surgical operations.

Key players, including Medtronic and GE Healthcare, are bullish heading into 2024. Medtronic, for its part, reports revenue growth across all four of its segments, citing better-than-expected sales, margins and growth in key product areas including diabetes and transcatheter aortic valve replacement. Late in 2023 the firm raised its revenue and earnings forecasts for the 2024 fiscal year, and now expects organic revenue growth of 4.5%. In September 2023, the firm announced it had received CE Mark approval for its new disposable Simplera continuous glucose monitor, which encompasses a “smart” insulin pen.

And, GE Healthcare, riding the momentum of its spinoff from General Electric, reported a 5- to 6% revenue gain in 2023 year-over-year, driven by sales of equipment for molecular imaging, computed tomography and magnetic resonance imaging, and specifically citing supply-chain improvements, pricing and new-product introductions. For 2024, Fitch Ratings expects 3.9% revenue growth from GE Healthcare, as the firm continues to expand its portfolio of digital platforms, including wearable and wireless monitoring systems.

All of this has medical-industry contract manufacturers flush with opportunities. From Ameco Research: “The medical-device contract-manufacturing market is forecasted to grow at a CAGR of 11.8% through 2030. North America, especially the United States, dominates the market due to its advanced healthcare infrastructure and robust regulatory frameworks.”

Per the Cain Brothers report noted earlier, “steadily over the past few decades, the medical device sector has made greater use of supply chain partners that do component, subassembly, and even final assembly manufacturing to optimize specific segments on the value chain.”

Medical-equipment OEMs continue to count on contract manufacturers (according to Ameco Research) for their cost-effectiveness and scalability; quality assurance and adherence to industry standards and regulations; rapid commercialization; and quick time-to-market. Metal stampings are found in a variety of medical applications, including surgical instruments, equipment housings and enclosures, imaging machines, reusable and single-use devices, probes, and more.

Finally, in a new white paper, “Supply Chain Resiliency in Medical Device Manufacturing: The Core Foundations,” Justin McCabe, operations manager for the MedAccred supply-chain oversight program, administered by the Performance Review Institute, stresses the importance of building resilient supply chains throughout the industry. “As much as 80% of supply-chain disruptions for OEMs are caused by lack of visibility and transparency at lower levels in the chain,” he says. Other concerns:

- A need for tools to accurately assess suppliers and identify risks

- Difficulties in allocating resources to identify and mitigate against risks.—BK

Aerospace Market Outlook

The global airline industry should realize net profits of $25.7 billion in 2024, according to the International Air Transport Association, with operating profits reaching a record $49.3 billion. Offers Forbes: “This projection, coupled with an expected surge in passenger traffic, paints a picture of an industry on the cusp of a historic rebound.”

After the pandemic decimated air carriers and suppliers alike as passengers dwindled and orders sank, a historic rebound indeed is in order.

“In 2024, airline capacity will finally exceed 2019 levels,” says Dan Taylor, head of consulting at IBA, an aviation market intelligence and consultancy company that in late December released its global aviation outlook for 2024. Taylor notes North American airline capacities will increase by 11% through this year, and 10% globally. But, according to IBA, 2024 will see an undersupply of aircraft, as OEM production and MRO capacity remain under pressure. This leads to airlines holding planes in service longer and extending leases, which impacts aircraft orders, and may extend replacement/service-part work for suppliers.

“In 2023, the pace of replacement of previous-generation aircraft has been far slower than expected,” says Mike Yeomans, IBA director of valuations and consulting. “IBA’s early modeling of when the Airbus neo and Boeing Max fleets would overtake (previous-generation aircraft targeted for replacement), suggested an approximate 2026 timeframe. This now will stretch beyond 2030 for both families.”

Through 2042, The Cirium Fleet Forecast predicts delivery of 46,260 new passenger and freighter jet and turboprop aircraft—30 seats and more, and their freighter equivalents—worth an estimated $3.2 trillion.

Cirium also reports ramped-up new-aircraft production through 2026 as the industry’s new growth cycle gathers momentum. For example, Airbus is planning to reach unprecedented monthly volumes of 75 aircraft for its A320neo family in 2026. While deliveries steadily recovered since 2021, full recovery beyond 2019 levels is not expected to be achieved until 2025.

“Comparing our 2023 delivery forecast to 2022, (we see) 9% fewer deliveries in the 2023-2025 period due to factors such as supply-chain and production-quality issues,” the Cirium report reads. At that point, expect the industry to return to more traditional growth paths.

The annual delivery value will recover to above $100 billion in 2024 and then rise to almost $200 billion by 2042, according to Cirium, which notes that “Airbus and Boeing will remain the two largest commercial aircraft OEMs, between them delivering an estimated 89% of aircraft worldwide through 2042,” but with more than $360 billion of demand for other OEMs as well new programs.

On the technology end, Cirium reports no hybrid or hybrid-electric airliners included in its forecast, but sees them as likely the next powerplant directions. Such programs now in development include a 30-seat battery-electric airliner, hydrogen-electric powertrains for retrofit on nine 80-seaters and a hydrogen-fuel-cell-powered 50-seater undergoing flight testing.

On another front, Honeywell projects 8500 deliveries of business jets worldwide from 2024 through 2033, valued at $278 billion. North America currently represents 64%of business jets in service.

And, for the first time, the 10-yr. global market for military aircraft is expected to reach $1 trillion, according to the 2024 Military Fleet & MRO Forecast from Aviation Week Network. With strategic tensions driving demand, the forecast predicts the acquisition of more than 20,000 military aircraft through 2033. And, an additional $1.4 trillion is expected to be spent on MRO for the global fleet of military aircraft over the period as air forces worldwide look to improve readiness levels. The largest program in the forecast: Lockheed Martin’s F-35 fighter plane, with at least 1600 aircraft worth $165 billion due to be delivered between 2024 and 2033.

New opportunities exist for suppliers, according to Aviation Week Network, with $202 billion in open requirements worldwide through 2023 including $50 billion in North America.

Higher in the sky, SpaceX, United Launch Alliance and others have a multitude of rocket launches planned in 2024, as the space market maintains its positive growth. If the 2024 U.S. launch schedule holds, it will surpass the record of 100 launches in 2023. Worldwide, the number of orbital launch attempts last year rose by 20% as compared to 2022, with a record 223 flights attempted and 212 reaching orbit, as reported by Aviation Week.—LK

Construction and Related Hardware Market Outlook

Expect stronger growth in 2024 for nonbuilding, and residential and nonresidential construction, according to the Dodge Construction Network’s (DCN) Outlook 2024. The outlook forecasts total construction starts to rise 7% to $1.2 trillion, surpassing 2023’s 1% growth.

The MetalForming 2023 forecast (January-February 2023 issue) cited the Infrastructure Investment and Jobs Act and the Inflation Reduction Act as positively influencing infrastructure spend, and related gains in construction (including off-road vehicles) and hardware markets. With U.S economic growth expected to improve through 2024, all of these sectors should improve. The DCN Outlook reports most sectors of the infrastructure-construction market to grow more than 10% in 2024. More from the DCN Outlook 2024 on residential:

- Single-family construction increases 9 percent to $244 billion with a 3% gain in number of units

- Multifamily construction starts increase by 14% to $161 billion with a 3% gain in number of units

Consider that the DCN Outlook measures U.S. housing stock as 3.3 million units short of satisfying demographic growth, so that portends a rosy residential-construction market in 2024 and beyond.

On the commercial side, expect a 2% decline in 2024—the pandemic-affected office market plays a big role in this number. On the plus side, reshoring has impacted manufacturing construction significantly. Starts in 2024 will increase by 16% in dollar value, according to the DCN Outlook, as long as the construction labor shortage is addressed.

With strong infrastructure and building construction outlooks, sectors such as hardware and off-road construction vehicles will reap the benefits—expect strong upward growth through 2024 and beyond.

Fasteners form a significant subset of the construction and hardware markets, and with that in mind note that the global industrial-fasteners market is expected to grow at a CAGR of 4.9% through 2032 to $153 billion, according to Precedence Research.

Positively impacting market development through the forecast period will be the rising output of machinery, automobiles and other durable goods due to various nations’ expanding economies. North America currently dominates the industrial fastener market, according to Precedence Research, and that is expected to continue.—LK

Appliance Market Outlook

In general, as the housing market goes, so goes the ultra-competitive appliance market, both for larger white goods and smaller appliances. The pandemic toyed with this relationship, as a stay-at-home mindset saw demand soar, with suppliers struggling to meet it. Fast-forward to today, where again appliance demand follows housing, benefitting from new housing sales and starts, and declining as mortgage rates have risen.

As it stands, major household appliance manufacturing revenue in the United States has been rising at a CAGR of 2.3% through year-end 2023, according to industry-research firm IbisWorld. In 2024, overall major-household-appliance revenue in North America is expected to reach $84 billion (compared to China’s world-leading revenue of $160 billion), offer analysts from Statista, while citing CAGR growth of 3.29% through 2028. On a volume basis, Statista projects the North American market to total 671.3 million major-appliance pieces by 2028, with the average per North American household estimated at 3.43 pieces in 2024.

In its forecast, Technavio projects the major-household-appliance market to grow at a rapid pace, CAGR of 4.2%, through 2028, which equates to dollar growth of $85.4 billion. The firm projects Asia-Pacific markets to contribute 46% of this growth. Stated reasons for growth: innovation and product launches, the growing adoption of smart home appliances and the rise in discretionary income of consumers.

Global market size for small electrical appliances is expected to see strong growth, to $230.83 billion in 2028 at a CAGR of 9.2%, according to The Business Research Company.

Major appliance manufacturers have tread carefully to maintain and grow market share in turbulent post-pandemic times.

“Discretionary purchases have been even softer than anticipated due to increased mortgage rates and low consumer confidence,” Whirlpool chief executive officer Marc Bitzer told Bloomberg in mid-2023. To combat that, the company cut $800 million in costs during the year, which it expects to carry over into 2024. Electrolux took similar cost-cutting measures in 2023, targeting U.S. operations following pre-pandemic investments. Stay tuned as the volatile appliance industry steels against a volatile economy in 2024.—LK MF

Technologies: Management

Rumors of the dearth of auto-segment activity were greatly exaggerated, it appears.

Rumors of the dearth of auto-segment activity were greatly exaggerated, it appears. In the European market, EV sales nearly doubled U.S. sales, at 14.3%; China’s EV sales tripled that of the United States, at 22.6%. Overall, battery electric vehicles (BEVs) lead all other EV forms in sales.

In the European market, EV sales nearly doubled U.S. sales, at 14.3%; China’s EV sales tripled that of the United States, at 22.6%. Overall, battery electric vehicles (BEVs) lead all other EV forms in sales. Siemens, Eaton, Johnson Electric and other manufacturers of electrical equipment—and their suppliers—enjoyed an overall healthy marketplace in 2023, as revenue in the segment climbed by more than 10%, according to data provided by several market-research firms. Driving forces include ramped-up sales of transformers, electric motors, switchgear and other related products.

Siemens, Eaton, Johnson Electric and other manufacturers of electrical equipment—and their suppliers—enjoyed an overall healthy marketplace in 2023, as revenue in the segment climbed by more than 10%, according to data provided by several market-research firms. Driving forces include ramped-up sales of transformers, electric motors, switchgear and other related products.  Likewise, an end-of-year report from EPS News, authored by Flip Electronics’ president Bill Bradford, notes:

Likewise, an end-of-year report from EPS News, authored by Flip Electronics’ president Bill Bradford, notes: With numerous industries expanding production volumes to fulfill growing demand for manufactured goods, the need has increased for energy-efficient equipment in various industrial operations. Consider that energy-intensive industries such as oil and gas, food and beverage, and power, spend nearly 40% of production costs on electricity. Such percentages drive regulatory authorities to encourage the adoption of energy-efficient equipment such as HVAC, according to Technavio.

With numerous industries expanding production volumes to fulfill growing demand for manufactured goods, the need has increased for energy-efficient equipment in various industrial operations. Consider that energy-intensive industries such as oil and gas, food and beverage, and power, spend nearly 40% of production costs on electricity. Such percentages drive regulatory authorities to encourage the adoption of energy-efficient equipment such as HVAC, according to Technavio.