The Link Between Total Cost of Quality and Profitability

March 1, 2011Comments

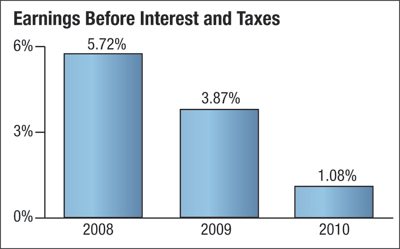

The metalforming industry has been challenged with decreasing revenues and profits. Profitability, as measured by EBIT (earnings before interest and taxes) is at the lowest level, 1.08 percent, since the Precision Metalforming Association’s (PMA) Benchmarking Report started tracking this metric (Fig. 1). During these challenging times, companies are continually looking for s to positively impact profits.

Fig. 1

Over the last several years, we have studied the results of companies that have participated in this report, looking for patterns and trends to connect operational performance to profitability. The one constant theme that has emerged is that there is no “silver bullet.” Better profitability is not guaranteed just by being best-in-class in any one of the metrics tracked in the report, including employee turnover, internal failure rate or capacity utilization.

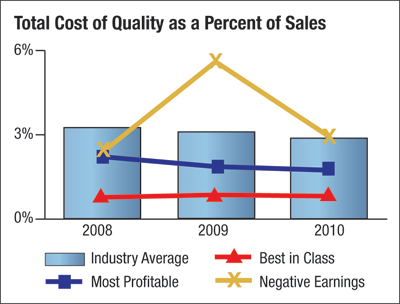

Nevertheless, our analysis does show that certain metrics do have a positive correlation with profitability. One example is total cost of quality as a percent of sales, where strong performance appears to be a driver of profitability, or, at the very least, an attribute of profitable companies. Because of its close association to profitability, let’s take a closer look at total cost of quality, how it affects profitability, and how companies use benchmark data to improve.

What is Total Cost of Quality?

The PMA Benchmarking report calculates the total cost of quality as a percent of sales by combining the costs for prevention, appraisal, internal failure and external failure, all measured as a percent of sales.

Overall, the metalforming industry has done a good job of driving down total cost of quality. The industry average (see Fig. 2) has steadily declined from a cost of 3.21 percent of sales in 2008 to 2.86 percent in 2010.

|

| Fig. 2 |

• Best in Class represents the performance level of the 90th-percentile company without regard to its level of profitability.

• Most Profitable represents the performance of the most profitable companies, the top 10 percent in terms of EBIT.

• Negative Earnings represents the performance of the companies that reported negative EBIT.

The most profitable companies in the report performed better than average, while the companies that lost money generally performed below average, making total cost of quality an important metric for companies to monitor.