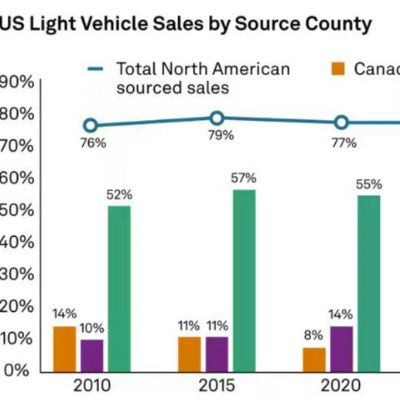

The threat of tariffs is not limited

to China and other South-Pacific nations.

New tariffs have been suggested for

some of our closest trading partners, including Canada, Mexico and Europe. To

complicate the issue, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, is set to be

renegotiated in 2025, with the first revision to be presented in 2026. Tariff

discussions among North American members will impact those negotiations.

Manufacturers also should anticipate potential retaliatory tariffs from impacted trading partners. When American-issued and retaliatory tariffs are considered in the context of market geographies and state-level regulations, the overall impact on individual companies could be positive, negative or mixed. The impacts may be especially complicated for companies doing business in U.S. states along America’s northern and southern borders.

New Cybersecurity Protocols

for Defense Contractors

In October 2024, the Department of

Defense (DoD) issued final regulations around

the Cybersecurity Maturity Model

Certification (CMMC), a process that began during Trump’s first administration. The CMMC rules require private-sector companies doing contracted work for the DoD to implement cybersecurity standards at progressively advanced levels, depending on the type and sensitivity of unclassified DoD information in the company’s possession.

There are three levels of required compliance, with Level 1 calling for 15 different security controls, Level 2 requiring an additional 110 safeguards and the third level (“Expert”) requiring an additional 24 security controls.

Manufacturers working directly with

the DoD and/or their suppliers will need to determine whether their information

security protocols and protections are sufficient and remedy any deficiencies

to continue to work on government contracts or bid on new work. The regulations

took effect on December 16, 2024, and CMMC requirements are expected to be

included in new DoD contracts starting in mid-2025.

New R&D Tax Credit Form

Beginning in tax year 2024,

manufacturers will see changes to Form 6765,

the tax form used to claim the federal R&D tax credit.

Those immediate changes include new line items for officer wages and more

detailed reporting requirements for research activities. However, the 2025

requirement for project-based accounting is a more significant shift, requiring

manufacturers to track R&D activities at a more granular level.

While the R&D tax credit provides

for additional tax savings and opportunities to improve cash flow, they also

increase the complexity of tax filing for businesses. In hopes of simplifying

the process, the Treasury Department requested feedback on the form.

End of Chevron Deference

Means More Regulatory Uncertainty

As new leaders take the helm at various federal agencies, 2025 may provide the first practical test of a Supreme Court ruling issued in June 2024 (Loper Bright Enterprises v. Raimondo), which reversed a 1984 decision commonly referred to as “Chevron deference.”

In its 2024 decision, the court

revoked the latitude previously given to government agencies to interpret and

implement laws, seeking to curb possible overextension of government authority.

In this new and uncertain environment, regulations likely will be applied much

more narrowly, and it may also be easier to challenge agency regulations in

court.

OMB’s Temporary Pause on Federal Financial Assistance Programs

The Office of Management and Budget

(OMB) issued a significant memorandum on

January 27, 2025, directing federal agencies to temporarily pause activities

related to federal financial assistance programs.

This directive affects a broad

spectrum of federal funding mechanisms, including grants, loans and other forms

of financial assistance that collectively represent more than $3 trillion in

federal spending.

Manufacturing and distribution businesses may face delays in federal

programs supporting advanced manufacturing, workforce development and export

assistance.

What’s Next?

The convergence of these policy

changes creates opportunities and challenges for U.S.

manufacturers. On the tax front, the potential extension of TCJA provisions

could provide benefits, particularly through bonus depreciation and R&D

incentives. However, manufacturers should prepare for more complex

documentation requirements, especially regarding R&D tax credits.

When it comes to trade policy,

tariffs may protect certain domestic industries, but they also

will affect global supply chains and input costs. Manufacturers should

consider:

- Diversifying supplier networks to

reduce dependency on single countries or regions

- Evaluating the impact of potential

retaliatory tariffs on export markets

- Assessing opportunities to reshore or

nearshore certain operations

- Preparing for USMCA renegotiations and

potential changes to North American trade relationships.

The cybersecurity requirements for

defense contractors signal a broader trend toward increased focus on digital

security. Even manufacturers not directly involved in defense contracts should

consider these standards as potential benchmarks for future industrywide

requirements.

Looking ahead, manufacturers should

focus on:

- Reviewing tax strategies in light of

pending TCJA changes

- Strengthening documentation processes

for R&D activities

- Evaluating supply-chain resilience against potential trade disruptions

- Assessing cybersecurity protocols

against evolving standards

- Building relationships with legal

experts to navigate the post-Chevron regulatory landscape.

See also: Wipfli LLP

Technologies: Management