On the demand side, the anticipation of growth is based on a receding inflation rate, pent-up demand, increasing wages and lowering vehicle costs. “The labor market—a key driver of vehicle sales in the U.S. market—is expected to weaken, but unemployment levels will remain low enough to support a healthy auto industry,” Cox Automotive states.

On the demand side, the anticipation of growth is based on a receding inflation rate, pent-up demand, increasing wages and lowering vehicle costs. “The labor market—a key driver of vehicle sales in the U.S. market—is expected to weaken, but unemployment levels will remain low enough to support a healthy auto industry,” Cox Automotive states.

U.S. Wages Increased an Estimated 5.7% from January to October. “Wage growth will cool in 2024 but will remain above average,” the firm continues. Cox projects that automaker vehicle incentives will be higher than previously, and discounting will increase. “Affordability will continue to improve, as household incomes increase, loan rates stop increasing (and maybe come down some), and vehicle prices in new and used react to the market’s undeniable downward price pressure.”

U.S. Wages Increased an Estimated 5.7% from January to October. “Wage growth will cool in 2024 but will remain above average,” the firm continues. Cox projects that automaker vehicle incentives will be higher than previously, and discounting will increase. “Affordability will continue to improve, as household incomes increase, loan rates stop increasing (and maybe come down some), and vehicle prices in new and used react to the market’s undeniable downward price pressure.”

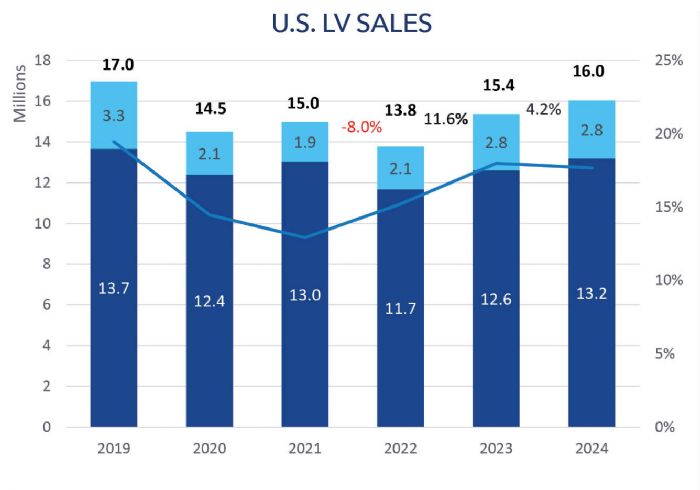

Automotive analyst Jeff Schuster, executive vice president, GlobalData, forecasts U.S. light-vehicle sales to rise slightly to 16 million in 2024. S&P Global Mobility forecasts 88.3 million new-vehicle sales worldwide in 2024 as the recovery rolls on.

Effects of Union Strikes, Resolutions and Higher Wages

The United Auto Workers (UAW) strike and subsequent wage increases had little impact on the market overall, according to a Wall Street Journal article. “A six-week United Auto Workers strike this past fall did little to damp the industry’s momentum and electric-vehicle (EV) sales continued to rise, albeit at a slower rate than in the previous year.”

The strike did impact the industry in at least three ways.

The strike did impact the industry in at least three ways.

Six-Week Halt. First and obviously, it prompted another round of production disruptions, though for only six weeks. The industry seems to have recovered.

Wage Increases. The wage increases prompted nonunion automakers to increase wages at their plants, and higher wages are sought in other industries. “Car companies with production facilities in the United States are bumping up pay for their non-union workers after the UAW secured record wage hikes and benefits for union workers at the Detroit Three automakers,” Reuters reports.

Cost of Production. Cost-of-production increases are imminent, but not significantly so. The labor component comprises only 7 to 10% of a vehicle’s cost, industry experts say. “The labor contracts don’t mean you go to a dealership and the car costs more money,” says Ivan Drury, analyst for sales tracker Edmunds, as reported by cnn.com. “If wages go up 11%, an overnight change in prices is not realistic. The end result is that for the consumers, the labor cost doesn’t mean a lot.”

According to Ford chief financial officer John Lawler, the labor deal is likely to raise the cost of building a vehicle by about $200 more per year, or $950 over the 4½-yr. contract.

According to Ford chief financial officer John Lawler, the labor deal is likely to raise the cost of building a vehicle by about $200 more per year, or $950 over the 4½-yr. contract.

On the other hand, GM claims that the wage increases will take a bite out of the company’s capital earmarked to transition to EVs.

Three auto-supplier spokespersons for NN Inc., North American Stamping Group (NASG), and Ultratech Tool & Design said that the UAW strike had little effect on their businesses.

NN Inc., headquartered in Charlotte, NC, with global reach, counts more than 3400 employees at 27 manufacturing facilities. “The strike didn’t really affect us,” says Bill Curtis, die maker/developer at its Algonquin, IL, tooling facility. “It really didn’t slow any of our current automotive business at all. We’re building and ramping up tooling.”

“We escaped unscathed,” says Michael Haughey, president and chief executive officer of NASG, echoing Curtis’ remarks. NASG is a Tier-Two, 100%-automotive supplier of seating, ride control, noise-vibration-harshness, and exhaust components and assemblies, with locations in the United States, Canada and Mexico. The company has $500 million in annual sales, 1300 team associates and 1.5 million sq. ft. of manufacturing space. “We were fortunate,” he adds.

“We escaped unscathed,” says Michael Haughey, president and chief executive officer of NASG, echoing Curtis’ remarks. NASG is a Tier-Two, 100%-automotive supplier of seating, ride control, noise-vibration-harshness, and exhaust components and assemblies, with locations in the United States, Canada and Mexico. The company has $500 million in annual sales, 1300 team associates and 1.5 million sq. ft. of manufacturing space. “We were fortunate,” he adds.

Haughey believes that companies lost a lot of people during the “Great Reset” because the lack of loyalty from management to employees was reciprocated. “We decided we were not going to lay anyone off. It’s very hard to be without a job.”

Haughey says that the company prepared for the strike’s potential effects by cutting overtime and nonessential activities ahead of time to shore up reserves.

Andy Melang, business development/program manager for Ultratech Tool & Design, a shop with 10,000 sq. ft. of space and fewer than 50 employees, says that the strike did have an impact, but only for one month. “The month of October was tough, but being that the strike was done in phases probably made it less painful for everybody.”

Melang says that the company reduced hours but didn’t have major layoffs. He adds, “We were diversified enough to get through it.”

Leveling Prices?

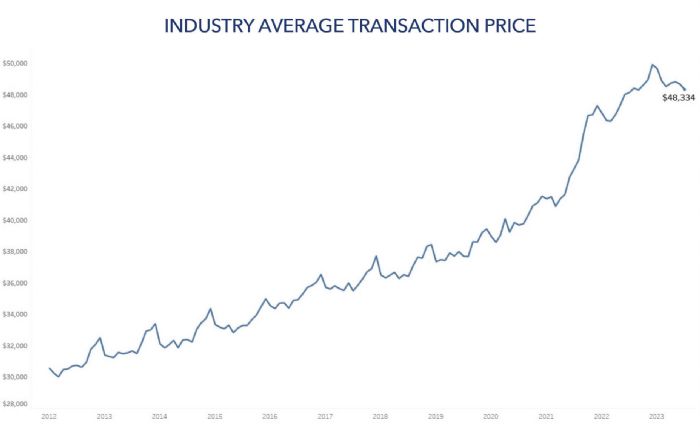

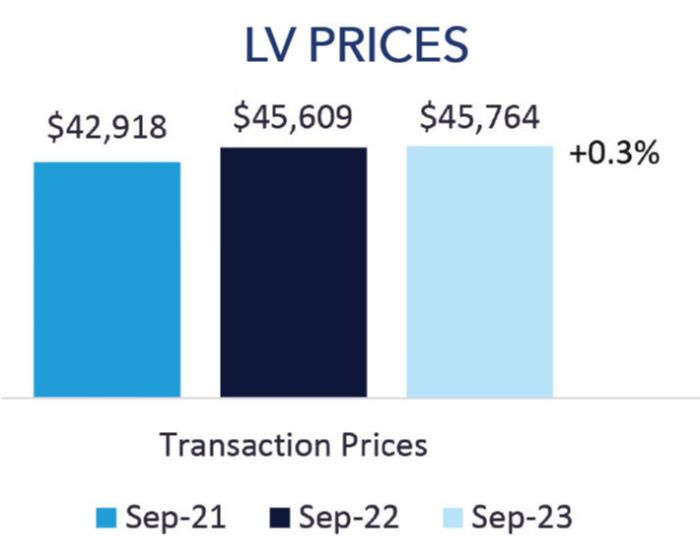

Vehicle prices appear to be stabilizing. After 3 yr. of escalation, vehicle prices in the United States began to level off in the fall, even dropping, GlobalData’s Schuster says. The average transaction price for a new vehicle in September 2023 was $45,764, only a $55 increase year over year, Cox Automotive relays. October and November transaction prices actually declined, counter to the typical trend in which the average vehicle price increases from year to year at roughly 2.5%.

Vehicle prices appear to be stabilizing. After 3 yr. of escalation, vehicle prices in the United States began to level off in the fall, even dropping, GlobalData’s Schuster says. The average transaction price for a new vehicle in September 2023 was $45,764, only a $55 increase year over year, Cox Automotive relays. October and November transaction prices actually declined, counter to the typical trend in which the average vehicle price increases from year to year at roughly 2.5%.

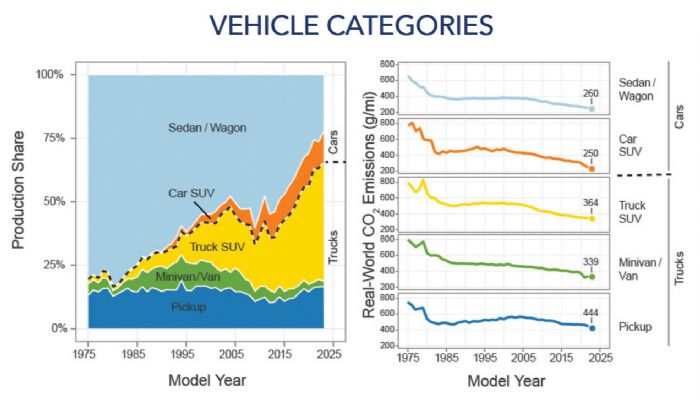

Then in December, the average transaction price for a new vehicle in the United States jumped to $49,507. Cox Automotive attributes the increase simply to consumers buying more expensive models. Americans increasingly have preferred the more expensive light-duty trucks and SUVs over sedans and vans for more than a decade. In 2010, about 27% of vehicles purchased were SUVs and light-duty trucks. That jumped to 50% in 2019; now more than 80% of vehicles sold in the United States are trucks or utility vehicles, according to the U.S. Environmental Protection Agency.

Some analysts predict that consumers won’t see an increase at all in 2024, and in fact, average transaction cost may decrease—even if the cost to automakers of building a vehicle increases. Here’s why:

Previous Price Escalation. Pre-strike, vehicle prices already had jacked up substantially as a result of the supply-chain disruption and constricted supply—often way above the manufacturer’s suggested retail price (MSRP).

Previous Price Escalation. Pre-strike, vehicle prices already had jacked up substantially as a result of the supply-chain disruption and constricted supply—often way above the manufacturer’s suggested retail price (MSRP).

Expanded Supply. New-vehicle inventory is steadily improving. Analysts forecast that the loosening supply will trigger lower MSRPs and automaker incentives for buyers.

Government Vehicle Incentives. Beginning this year, vehicles over a specific price point do not qualify for the $7500 federal tax credits offered as part of the Biden Administration’s Inflation Reduction Act. This gives automakers a strong incentive to lower their vehicle prices so that they qualify for the incentive and provides a downward push on vehicle prices.

Electric Vehicles Ahead: Recalculating Route

The most unpredictable lever remains the auto industry’s shift to EVs, resulting in uneven forecasts and production volume uncertainty. The federal Clean Vehicle Credit provided in the Inflation Reduction Act helped boost EV sales. But even there, changes in qualifications for the $7500 incentive per vehicle prize created upheaval.

EV Sales Rebounded. Early on, it appeared that EV sales would drag behind forecasts. Demand for EVs, especially in the United States, did dip, but only slightly, as sales surged at the end of the year.

The battery EV (BEV) share of new vehicle sales in 2023 in the United States was a record 7.6%, blowing past the one-million-unit mark for the first time, ending up at 1.2 million units sold, as reported by The National Automobile Dealer Association and Cox Automotive. That was an increase of 50.7% year over year.

In the European market, EV sales nearly doubled U.S. sales, at 14.3%. China’s EV sales tripled that of the United States, at 22.6%.

Not everyone is optimistic about EV growth. In an October article, Fortune pointed to Tesla’s numbers falling short of earlier forecasts. According to its third-quarter 2023 earnings call, Tesla reported revenue of $23.4 billion, short of the $24.1 billion forecast. Tesla is still profiting, up 9 percent from a year earlier.

Still, range anxiety and affordability are constraining many buyers from jumping on the EV train. Although the Bipartisan Infrastructure Law has slotted $5 billion to expand the high-speed charging network, the not-yet developed charging network, and higher-than-ICE-vehicle sticker prices are restraining consumer acceptance.

Scaling Back Production. Several automakers are scaling back their production-volume plans and some are waiting to build production facilities. Other automakers that were planning to cut production volumes are resetting them.

Ford, for example, cut one of three shifts at the Rouge Electric Vehicle Center that builds its electric F-150 Lightning pickup truck, citing multiple constraints, including supply-chain issues.

By year’s end, the automaker reported a record year for its electric fleet sales, up 18% over 2022. Ford sold 72,608 Mustang Mach-Es, F-150 Lightning trucks and E-Transit vehicles, the Detroit Free Press states. Mustang Mach-E sales rose 3% in 2023 with 40,771 vehicles sold and the best year since launching it in 2021. Ford’s E-Transit remained America’s best-selling electric van in 2023 with sales of 7,672 vehicles up 18% over 2022. The F-150 Lightning, a model for which Ford earlier had broken previous sales records, too—up 55% over its 2022 sales, according to the automaker, putting it in second place for EV sales after Tesla.

GM is scaling back its self-imposed target of manufacturing 400,000 EVs by mid-2024, the Wall Street Journal reported in October. The Detroit automaker claimed that the UAW strike cut into its capital to fund the investment, while reporting a healthy third-quarter profit. Observers view the cutbacks as a sign that automakers are reassessing the market demand for battery-powered cars.

Even within the ranks of automakers’ own companies, their uneven commitment is showing. They sent out mixed messages, in some cases, downplaying the switch to EVs while also investing heavily in it. For example, Toyota chair and former chief executive officer Akio Toyoda, who has long been a skeptic, reacted to the Tesla October earnings report, saying, “People are finally seeing reality.” Then, in the same month, Toyota announced an $8 billion EV battery-plant investment.

Volvo Cars chief executive officer Jim Rowan is optimistic about the long-term potential of EVs, but is more cautious about solid-state batteries.

The appetite for EVs is larger globally than in the United States. EV sales in 2023 in Europe were 14%; in China, even higher at 27%.

Federal Incentives Shift to Favor American-Made. The Biden Administration’s Inflation Reduction Act tightens requirements for the Clean Vehicle Credit, designed to boost U.S. and North American manufacturing with qualifications that favor American-made vehicles. The requirements also are designed to make the vehicles more affordable.

For an EV to qualify for its buyer to receive the full U.S. $7500 incentive, several stars must align. It gets a little complicated.

Vehicles that cost over a certain price are disqualified. To qualify for the incentives in 2024, the MSRP for a passenger vehicle cannot exceed $55,000, or $80,000 if it is an SUV, pickup truck or van. The vehicle must be assembled in North America. At least 60% of the value of the battery components must be made in North America, and at least half of critical minerals extracted, processed and recycled must be from North America or a U.S. free-trade partner. (The battery component and critical minerals percentages rise each subsequent year.) The battery capacity factors into how much credit is available—minimally 7 kW hr. So does the vehicle weight (it must be less than 14,000 lb.).

Vehicle price and buyer incomes also come into play. The buyer’s adjusted gross income limit is $300,000 for joint/married filers; $225,000 for a head of household; and $150,000 for single tax filers.

To find out if a vehicle qualifies, consumers can check www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after.

Some Vehicles Lose Tax-Credit Eligibility. The new 2024 Clean Vehicle Credit requirements caused some vehicles to fall out of eligibility, while others previously disqualified by meeting the 200,000 quota fell back into the fold.

EVs that lost eligibility for the tax credits include the Nissan Leaf, Tesla Cybertruck All-Wheel Drive, some Tesla Model 3s, Chevrolet Blazer EV, Tesla Model 3 Rear Wheel Drive, BMW X5 xDrive50e, Audi Q5 PHEV 55, Cadillac Lyriq and Ford E-Transit, the U.S. Treasury says.

Automakers GM, Volkswagen, Tesla and Ford Nissan are responding accordingly to move their vehicles into the qualification zone by realigning their sourcing and reducing their prices. Tesla’s vehicle price cuts put many of its vehicles into the qualification range. The list may expand as automakers update their supply chains to comply with the Biden Administration’s sourcing requirements.

EV Prices Throttling Down. The most promising news about one of the two most important barriers to EV adoption—cost—is that MSRPs are trending down. Prices have an inverse relationship to inventories, declining as inventories have risen. At the end of July 2023, the EV segment days’ supply was 100 days, while industrywide days’ supply stood at 54, Cox states.

EV purchases may see some improvement in 2024 as EV prices trend downward. EV transaction prices—led by price cuts at Tesla—were down nearly 18% year over year in July 2023 to $53,469 from $65,108 one year ago, according to Cox. Tesla has been repeatedly cutting prices of its vehicles to meet the Clean Energy Vehicle tax credits and boost sales.

Clearly, the new price caps for an EV to qualify for the $7500 incentive have been one big driver for the cost-downs.

Price competition is heating up, with major cost competition coming from Chinese automakers, which are gaining a foothold in the auto market with EVs where they could not before. China’s government has heavily subsidized the industry, the Guardian reported.

Mercedes calls the intense price competition “brutal.” An October Guardian article quotes Harald Wilhelm, chief financial officer of Mercedes-Benz, that the electric car industry is “a pretty brutal space,” after the German carmaker reported a fall in profits.

Chinese EV maker BYD back-seated Tesla as the world’s biggest seller of EVs, counting both full-electric and hybrids in 2023. The automaker is inching closer to Tesla’s pure electric sales total as well. Third-quarter EV sales for BYD were 431,000, just behind Tesla’s 435,000, according to Quartz.

Upward Trajectory. Long range, EV sales are on an undeniable upward trajectory. Cox Automotive expects the EV market share to climb to 10% in 2024, and, collectively with plug-in hybrids and hybrids, is predicted to comprise a quarter of the market by the end of this year. “Hybrid models will add further to the mix, pushing the share of electrified vehicles—EVs, plug-in hybrids and hybrids—to near 24% of the market in 2024,” Cox Automotive projects.

The number of EV models available provides plenty of options for interested buyers. By the second half of 2023, 95 EV models were available in the United States, a 40% increase in just one year.

Auto Suppliers’ Spin on EVs

Stampers and auto suppliers say they will fare fairly well through the transition to EVs.

Ultratech’s Melang offers “All of it what we supply are structural parts, such as subframes and frame assemblies. There will be a need for those structural components … automotive seating, dash components, or even headliner components and roof systems. That stuff will survive the EV transition.”

99-He says that the company added a 500-ton press in 2023, a 600-ton the year before, and a 1000-ton in 2020. The stamper has plans to invest in higher-tonnage presses with larger beds than it has right now. “I think that auto in general is going to higher and higher strength steel, which of course drives tonnage. The press is one-half of that equation. Of course, having a new, state-of-the-art feed line to handle the very-high-strength material is needed.”

The division that Curtis works in for NN, Inc. currently is supplying the EV market. He says that the EV segment has generated business prospects and opportunities for the company. “Yes. It’s been good for us,” he explains “We actually just landed another set of tools for an EV for some shielding parts and some terminal and busbar-type parts.” NN regularly manufactures electrical parts as well as components for sensor manufacturers.

“It’s really our niche; electrical connections, terminals, contacts ... anything electrical,” Curtis continues. “We’ve done them for decades, so, it’s not really a transition for us. There are some slight material differences, but nothing major.”

NASG’s Haughey voices concerns about an EV slowdown. “Our customers have a lot of capital tied up in EV production. One of our customers has two lines dedicated to EVs and is using only half of one. Programs are getting extended. Volumes are being cut.” No new engine programs are being launched either, he remarks.

Although a sizable segment of the company’s business is in exhausts, Haughey says that the company is well-equipped to run EV parts instead. “Yes, we have a lot of exhaust business, but presses are part agnostic,” he offers. “We don’t have presses dedicated to one business.”

Ride Ahead: Cruising, Not Bruising

The slow but steady pace of this year’s auto industry is likely to be a welcome change. The jump starts and halts of previous years are predicted to be over, and a calmer year ahead.

Tooling Business Activity Boosted By Dual Propulsion

The dual-propulsion situation puts tool- and diemakers in a sweet spot, according to Laurie Harbour, president and chief executive officer, Harbour Results. Many new ICE vehicles and new BEV products will enter the market, she said. “A significant wallet is available for tool sourcing.

“A lot of new products are coming, and over 4 yr. this accounts for $25 billion in tool spend,” Harbour continues. “This is similar to what we saw in 2017-18—the largest spends in the history of the automotive tooling business. The future is bright for automotive.”

Stampers, Fabricators: Optimistic

“We’ll see a steady, constant, consistent flow, with probably a small increase in overall business revenue from the auto industry—it might be 5 to 10%,” Ultratech’s Melang says. “This year should be just kind of a no-drama, easy-going year.” He indicates that 2025 and 2026 look to be higher-growth years.

Curtis says that the tooling projects he’s working on at NN Inc. indicate business acceleration in 2024. “We have some projects in the pipeline on the tooling side. We’re building some tools and we’re getting some parts to PPAP, though we don’t have production for them yet.” He adds, ”You know, any automotive projects are going to have a launch curve but it seems a little farther out than normal.”

NASG recently has made investments in automation, automated-guided-vehicle (AGV) material handling and enterprise-resource-planning systems to position itself well for the automotive industry shifts. “We made a big dive into data so we can make better decisions,” Haughey says. He notes that the company made big efficiency gains and raised productivity with the AGVs.

The company has experienced a good deal since its founding in 1978, and Haughey is confident that it will fare well in 2024.

“First we went through COVID, then the supply-chain disruption, then the Great Resignation, then high inflation, then the UAW strike … the feds are doing a good job, but inflation has been stubborn.” He adds, “The shock gets less each time. We have to be resilient. Those that have learned to adapt, survive.” MF

View Glossary of Metalforming Terms

Technologies: Management

“The automotive industry, having navigated the challenges of the pandemic, continues its robust recovery. In 2024 we’re due to see the market bouncing back vigorously from the challenges of the past years. The sector has shown remarkable adaptability … reflecting a renewed consumer confidence and a robust economic rebound,” offers American International Group (AIG), an American multinational finance and insurance corporation, in “7 Automotive Industry Trends to Watch in 2024.”

“The automotive industry, having navigated the challenges of the pandemic, continues its robust recovery. In 2024 we’re due to see the market bouncing back vigorously from the challenges of the past years. The sector has shown remarkable adaptability … reflecting a renewed consumer confidence and a robust economic rebound,” offers American International Group (AIG), an American multinational finance and insurance corporation, in “7 Automotive Industry Trends to Watch in 2024.” Cox Automotive, parent company of Kelley Blue Book and Autotrader, agrees that the industry will grow, but projects that the pace of growth will be slower in 2024.

Cox Automotive, parent company of Kelley Blue Book and Autotrader, agrees that the industry will grow, but projects that the pace of growth will be slower in 2024.