Manufacturing Benchmarking: North American Companies Face Challenges

September 17, 2024Comments

The North American manufacturing industry continues to face significant challenges impacting revenue and capacity utilization, according to a recent benchmarking study from Harbour IQ, powered by Wipfli Manufacturing. On average, study respondents expect revenue to decrease 3.4% from 2023 to 2024, with 86% expecting profits to decline or be flat during that same period. Capacity utilization remains low (55%) for production operations–stampers, die casters and plastic processors–and for tooling suppliers (71%).

The North American manufacturing industry continues to face significant challenges impacting revenue and capacity utilization, according to a recent benchmarking study from Harbour IQ, powered by Wipfli Manufacturing. On average, study respondents expect revenue to decrease 3.4% from 2023 to 2024, with 86% expecting profits to decline or be flat during that same period. Capacity utilization remains low (55%) for production operations–stampers, die casters and plastic processors–and for tooling suppliers (71%).

The study, conducted during May with results released this week, included more than 340 participating facilities. Most respondents (41%) feel “neutral” about the outlook for the industry. Among top concerns: economic factors, including higher cost of doing business, continued inflation, upward wage pressures, rising energy costs and a U.S. recession.

“The industry as a whole is volatile,” says Laurie Harbour, a partner in Wipfli’s manufacturing practice. "Business owners across manufacturing report reduced volumes of 10 to 30% through the first half of the year. They are concerned and often times unclear about what they need to do to be competitive in the marketplace. It has never been more important for companies to hunker down and focus on building agility and flexibility into their businesses to better manage the uncertainty.”

Labor-related costs have dramatically increased year-over-year in the surveyed sectors. According to survey respondents, wages for starting and standard roles increased, on average, 4% in 2024, bringing the average hourly rate to $25.82. Although the wage rate has increased for the last 3 yr., according to the Bureau of Labor Statistics it still is well below the average U.S. manufacturing wage rate of $33.72. Additionally, benefit spending was reported to increase from 5.1% of revenue spent in 2023 to 11.5% in 2024.

Manufacturers Investing in Automation

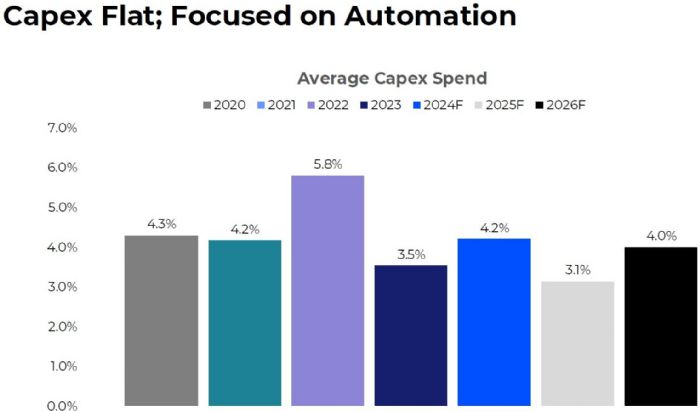

Despite marketplace instability, manufacturers continue to invest in their businesses. Study participants forecast capital-expenditure spend to range between 3 to 4% for the next 3 yr., with a large percentage of that spend dedicated to automation—dedicated cells, robots, cobots and automated material handling.

“This level of investment and focus on technology is promising,” adds Harbour. “The manufacturing industry is shifting to Industry 4.0 and integrating digital technologies and automation, which creates opportunities for improved efficiency and competitiveness.”

Manufacturers interested in learning more about state of the manufacturing and automotive industries are invited to attend the annual Automotive Tooling and Supply Chain Outlook, hosted by Wipfli and MEMA Original Equipment Suppliers, Oct. 23, 2024, in Livonia, MI.

See also: Wipfli LLC

Technologies: Management, Pressroom Automation, Training

Podcast

Podcast