Again, these

delays relate to the strike impact, according to Harbour, and OEM concerns in

committing to new capital investment.

“OEMS are pushing off some EV programs to the balance of the decade,” she says. “Again, we have a very bullish forecast overall, but some shifts definitely have occurred in the last half of 2023.”

Near-Term

Strike Impact

The affected OEMs

obviously see labor impacts, as hourly pay will increase well above the current

$64/hr. (wage and benefits) among the Detroit Three, as compared to Japanese

OEMS at about $55 and companies such as Tesla at $45-$50, according to Harbour.

This will eat into what had been record profits. Consider, too, that the UAW

strike resulted in significant unrecoverable lost production volume. Lower-tier

suppliers were particularly vulnerable during the strike as some felt impacts

within 40 hr. of strikes at specific OEM plants, which points to just how

tightly wound low-tier suppliers are to OEM operations.

It remains to

be seen if union efforts, upon the successes of this strike, affect transplant

OEMs and Tier Ones. Also, to compete with OEM wages, tier suppliers likely will

have to increase compensation, with an adverse effect on competing with

lower-cost foreign suppliers. These factors represent wildcards in forecasting,

and spell uncertainties for these tiers.

More Launches

Spur Tooling Spend

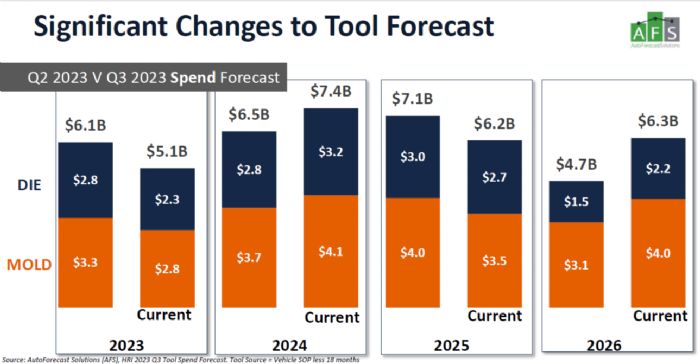

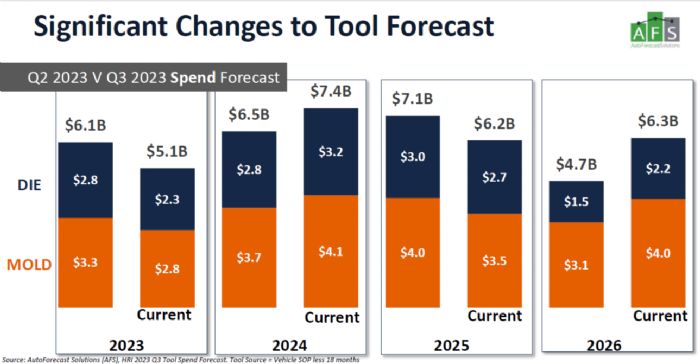

Given all of

the above, the current Harbour Results amended forecast sees North American die

and mold spend for automotive totaling $5.1 billion in 2023, $7.4 billion in

2024, $6.2 billion in 2025 and $6.3 billion in 2026 (see chart: Significant

Changes to Tool Forecast). New launches will drive tooling demand, with 47

launches planned for 2023, 64 for 2024, 48 for 2025 and 63 for 2026, according

to Harbour.

Given all of

the above, the current Harbour Results amended forecast sees North American die

and mold spend for automotive totaling $5.1 billion in 2023, $7.4 billion in

2024, $6.2 billion in 2025 and $6.3 billion in 2026 (see chart: Significant

Changes to Tool Forecast). New launches will drive tooling demand, with 47

launches planned for 2023, 64 for 2024, 48 for 2025 and 63 for 2026, according

to Harbour.

“OEMs will conduct product development next year for vehicles that come out in 2025-2027, when the economy should return to a level of robustness,” she says.

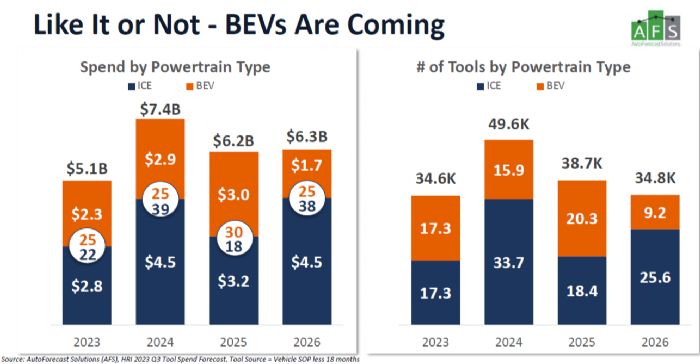

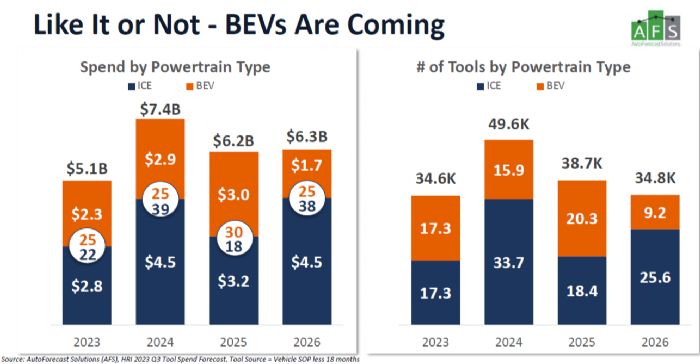

Also, battery

electric vehicles (BEVs) will make an increasing impact, Harbour reports,

though she envisions some program delays.

“The cost impact, particularly for the Detroit Three, will force the spreading out of some of these BEV programs and continuing renewal of ICE products,” Harbour reasons, “as ICE is where these OEMs make a lot of their margins.”

Nonetheless, expect to see a tremendous amount of tools on the horizon for BEVs (see chart: Like It or Not – BEVs Are Coming).

“Keep in mind that that BEVs require 30 to 40 percent less tooling than ICE products, but we're also seeing some trim levels removed on ICE products,” she says. “Some of this balances out, but we remain very bullish on what’s coming.”

Big Wallet for

Tooling Spend

“A lot of new products are coming, and over 4 yr. this accounts for $25 billion in tool spend,” Harbour says. “This is similar to what we saw in 2017-18—the largest spends in the history of the automotive tooling business. A significant wallet is available for tool sourcing.”

This

introduces a challenge: Where does that wallet get sourced?

Investment in

BEVs and the transitioning of assembly lines to produce these products sets the

stage for huge OEM capital expenditures (capex). With material price increases

carrying through the pandemic and the massive launching of new products,

managing capex is something to be studied closely.

Investment in

BEVs and the transitioning of assembly lines to produce these products sets the

stage for huge OEM capital expenditures (capex). With material price increases

carrying through the pandemic and the massive launching of new products,

managing capex is something to be studied closely.

“In 2018, the North American automotive industry consisted of 173 ICE models and two BEVs,” says Harbour. “By 2026, expect about 154 ICE models and 96 BEVs. That’s 43 percent growth in the number of models, and all require tooling.”

OEMs, to

combat higher labor costs arising from strike settlements along with all the

other stresses, will look to reduce trim levels and possibly outsource tooling

to overseas low-cost suppliers.

“This certainly continues to be an issue as OEMs look to balance their capex investments” says Harbour. “I can't project where OEMs will source their tooling, and this is the challenge faced by the North American tooling industry.”

One thing is for sure, though, according to Harbour: If OEMs claim that a lack of tooling capacity drives them to lower-cost overseas suppliers, don’t buy it.

“North America holds $9 to 10 billion of automotive tool capacity,” she says. “We forecast $6 to 7 billion annually in tool spend for the rest of the decade. While capacity has been reduced by 15 percent in the past 20 yr., we clearly still have plenty of capacity.”

Most concerning to Harbour regarding the 15-percent reduction in tool capacity is the share of that represented by producers of large tooling, for parts such as body sides. That’s challenging, but somewhat offset by tariffs on tooling from China.

“Bottom line,” according to Harbour: “We have the tooling capacity.” MF

See also: Wipfli LLC

Technologies: Management, Tooling, Training

Given all of

the above, the current Harbour Results amended forecast sees North American die

and mold spend for automotive totaling $5.1 billion in 2023, $7.4 billion in

2024, $6.2 billion in 2025 and $6.3 billion in 2026 (see chart: Significant

Changes to Tool Forecast). New launches will drive tooling demand, with 47

launches planned for 2023, 64 for 2024, 48 for 2025 and 63 for 2026, according

to Harbour.

Given all of

the above, the current Harbour Results amended forecast sees North American die

and mold spend for automotive totaling $5.1 billion in 2023, $7.4 billion in

2024, $6.2 billion in 2025 and $6.3 billion in 2026 (see chart: Significant

Changes to Tool Forecast). New launches will drive tooling demand, with 47

launches planned for 2023, 64 for 2024, 48 for 2025 and 63 for 2026, according

to Harbour. Investment in

BEVs and the transitioning of assembly lines to produce these products sets the

stage for huge OEM capital expenditures (capex). With material price increases

carrying through the pandemic and the massive launching of new products,

managing capex is something to be studied closely.

Investment in

BEVs and the transitioning of assembly lines to produce these products sets the

stage for huge OEM capital expenditures (capex). With material price increases

carrying through the pandemic and the massive launching of new products,

managing capex is something to be studied closely.

Podcast

Podcast