Tooling Suppliers Face Particular Stresses

Specific to tooling suppliers, OESA and HRI point out that the Detroit Three automakers have less than 45 percent of the North American market share, down from 87 percent in 1962. That’s a telling stat, as North American tool suppliers largely supply the Detroit OEMs, while other OEMs receive their tooling chiefly from overseas. That is seen as shifting to North America, but slowly. With more models coming out, and more of these models in smaller volumes, current production and supply models will be stressed, claim the report authors. And through all of this, the product itself is becoming more complex. For example, a particular molded front fender produced in 2005 required seven molds and fewer attachment points, with most of those of the lower-detail variety. In 2015, the fender for this same model required 12 molds and more than four times the operations, and with more attachment points, most of those more complex.

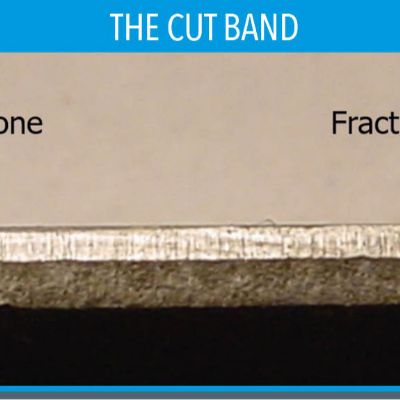

Materials required to produce new models also continue their rise in complexity, as use of medium- and higher-strength steel has increased 24 percent in the past four years while aluminum usage has increased 17 percent. The trend should continue into 2022 as automakers attempt to satisfy government fuel-efficiency standards.

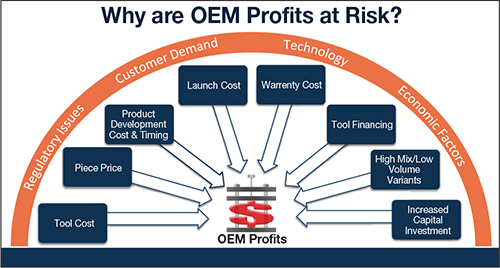

If that weren’t enough, shorter product lifecycles continue to trend, and are expected to drop further over the next five years. These shorter lifecycles translate to less time to amortize tooling and other capital. One way Tier suppliers can recover those costs is through higher piece prices, but that’s easier said than done. So it’s no surprise that all of these complexities have cut into profits of automotive suppliers.

For the tool and die industry, the factors listed above are compounded by challenges such as increased tool complexity, shorter lead times, lack of skilled labor, tooling jobs on hold, capital equipment needs and cash-flow management.

To manage their increasing tooling expenditures, OEMs will use a variety of cost-cutting tactics, according to Laurie Harbour, HRI president and CEO, including intense pricing pressure on tiers and tooling suppliers. OEMs also may opt to cut future programs, source tools overseas, communize platforms and components to harmonize tooling, use alternative tooling materials, and create a low-volume supply base.

As we can see, the challenges for automotive suppliers are formidable, and they are many. With investment continuing in order to capture strong automotive demand, the next few years will be interesting to say the least, and will require that the entire North American automotive supply chain stay on its game. MF

See also: Nidec Press & Automation, Eagle Press & Equipment Co. Ltd.

Technologies: Materials, Stamping Presses

In September, a Precision Metalforming Association Tennessee District meeting provided the opportunity to assess the current strength of the automotive manufacturing sector in the Southeastern United States and tour some of that region’s metalforming operations. Safe to say that the region remains healthy, a fact confirmed by discussions with several producers and suppliers at the 2015 FABTECH show this past November in Chicago.

In September, a Precision Metalforming Association Tennessee District meeting provided the opportunity to assess the current strength of the automotive manufacturing sector in the Southeastern United States and tour some of that region’s metalforming operations. Safe to say that the region remains healthy, a fact confirmed by discussions with several producers and suppliers at the 2015 FABTECH show this past November in Chicago.  The investments by NASG, Hatch Stamping and others show that the industry expects to remain strong and even grow. These predictions have remained accurate thus far, but a new industry report, the 2015 Automotive Tooling Update, an analysis of the automotive supply chain by the Original Equipment Suppliers Association (OESA) and manufacturing consultant Harbour Results, Inc. (HRI), suggests caution.

The investments by NASG, Hatch Stamping and others show that the industry expects to remain strong and even grow. These predictions have remained accurate thus far, but a new industry report, the 2015 Automotive Tooling Update, an analysis of the automotive supply chain by the Original Equipment Suppliers Association (OESA) and manufacturing consultant Harbour Results, Inc. (HRI), suggests caution.